Courrier des statistiques N2 - 2019

Profiling at INSEE A More Relevant Identification of Economic Actors

In statistics, the notion of enterprise has often been associated with its purely legal definition, i.e. the legal unit registered in the SIRENE register. This approach has the advantage of providing a wealth of administrative data, thereby reducing the survey burden on enterprises. However, with the emergence of enterprise groups, legal units owned by others are liable to lose all or part of their autonomy and, therefore, their status as an enterprise. "Profiling" is the term used to describe the technique of identifying enterprises in the economic sense within enterprise groups and then collecting and calculating statistics on the resulting new perimeter. This technique is now applied at INSEE to enterprise groups of significant economic importance operating in France. The approach requires direct collaboration between the group and a "profiler", a new profession that first appeared in the early 2000s. Monographs are essential to obtain robust statistics on major enterprise groups. However, because they are costly in terms of human resources, they cannot be applied to the 100,000 enterprise groups present on French soil. INSEE has therefore developed a new "automatic" profiling method first used in 2018.

- The origins of profiling

- The first experiments date from the late 1990s

- The value of profiling: an illustrative example

- A top-down approach to defining enterprises in the economic sense

- A bottom-up approach to calculating statistics on these new perimeters

- Several types of profiling

- Manual profiling: profiling as a profession

- Defining perimeters: getting as close as possible to the autonomy criterion

- The importance of dialogue for obtaining high-quality data

- Automatic profiling: lower cost, strong hypotheses...

- ... And adapted calculation methods

- Intermediate-sized groups, intermediate solutions

- What are the implications for the vision of the economy?

- Profiling: a long and unfinished history

- Box 1. Definition of Enterprise Within the Meaning of the Law on the Modernisation of the Economy of 4 August 2008

- Box 2. Consolidation of Turnover

The origins of profiling

Most of the names of CAC 40 companies and, more generally, of businesses that make the headlines on a daily basis are in reality names of "enterprise groups". However, although they account for two thirds of the added value of enterprises (a clear indication of their weight), enterprise groups have no legal existence and are not legal entities as such. This explains why enterprise groups have tended until recently to be ignored in practice in official statistics, with most countries basing their statistics on legal units only (i.e. individual entrepreneurship or companies), despite the fact that an increasing number of laws and regulations now refer to them. The result was that transactions between units of the same group, which in most cases do not comply with market rules and therefore do not have any real economic significance, were taken into account in business statistics. Having concluded that it was no longer relevant to rely solely on legal units to meet French or European regulatory requirements relating to business statistics, INSEE therefore decided to disseminate structural business statistics based on enterprises in the economic sense, the definition of which takes into account the notion of group. Doing so requires the design and implementation of a sophisticated methodology: profiling.

In the wake of general reflections on profiling in the 1990s, the first operational work was carried out in France in 2006 and 2007 through a CNIS working group (Ouvrir dans un nouvel ongletDepoutot, 2008). This is why INSEE, within the framework of the LME, set out to amend the definition of enterprises in the French official statistical system (Box 1).

These concerns are also reflected at a European level under the aegis of Eurostat, which has undertaken a major overhaul of the regulations governing European business statistics in the form of "FRIBS", which has now been adopted: a network-based working group (ESSnet) was launched in 2014 for a period of two years to work on the subject of profiling and the definition of "enterprise".

At the time, Eurostat noted that the official definition of "enterprise" was often imperfectly applied by many countries. The definition drawn from the European regulation (No. 696) of 1993 was subsequently included in the French LME in 2008 to define the various categories of enterprises. In 2015, Eurostat requested countries to comply with this definition when compiling structural statistics and to draw up an action plan to ensure such compliance is achieved by 2020 at the latest.

The first experiments date from the late 1990s

The need to "profile" certain enterprise groups first emerged at the end of the 1990s during a legal restructuring of the two major French car manufacturers, which had decided at roughly the same time to give legal personality to each of their local units. Thus, new cash flows, with no real economic consistency and corresponding to the physical flows of car components, emerged between the legal units of the enterprise groups. As part of the restructuring, the legal production units leased labour and machinery to certain legal units within the same group and sold their production to other legal units within the group in charge of their commercialisation. None of the new legal units had any real autonomy in terms of production or decision-making, with decisions clearly continuing to be taken at group level. As such, they did not meet the traditional criteria used to define an "enterprise" and were not full-fledged "economic actors". The restructuring referred to here resulted in the turnover, subcontracting, etc. of the French car industry being "fictitiously" multiplied by nearly three when in reality nothing had changed in terms of production capacity as a result of the restructuring, so that it was not possible to leave the new data as they were if the aim was to arrive at an economically significant situation.

This kind of decision, which involves creating several legal units within a new entity, can occur at any time within large groups. Therefore, the assimilation of the legal unit to the enterprise is no longer relevant in this type of case: decision-making autonomy and management of all factors of production take place at group level and no longer at the level of the legal units. Moreover, continuing to reason in terms of legal units not only changes the levels of the aggregates but also their sectoral distribution.

The value of profiling: an illustrative example

The proposed approach can be illustrated by the following fictitious example (Figure 1) involving an enterprise consisting of a single legal unit. In year N, the enterprise generates a turnover of €300K and creates an added value of €200K. It has several activities in its production process; let A be its NACE code which is assumed to be an industrial activity.

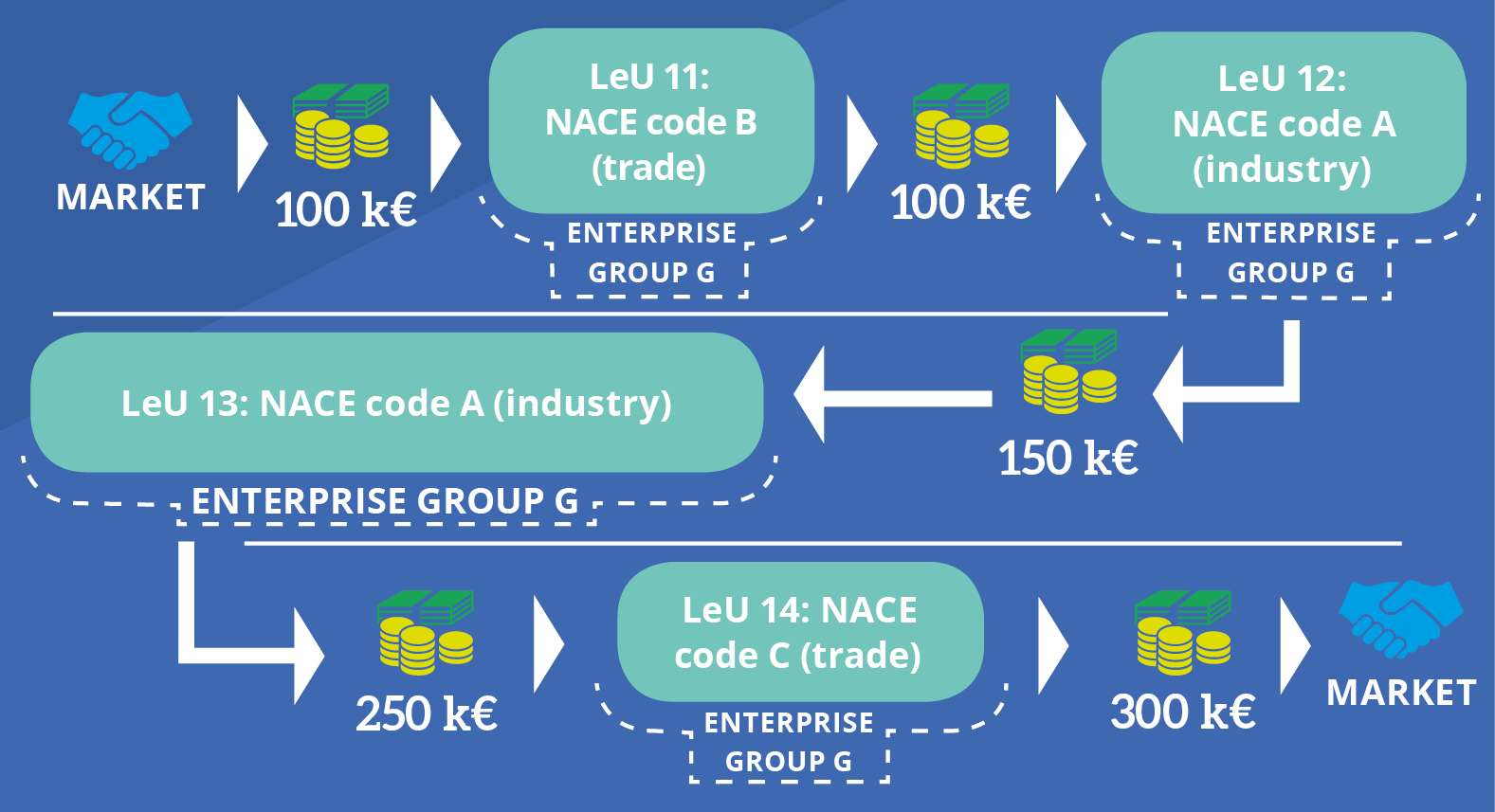

Let us now imagine that for tax reasons the managers of the enterprise decide to create a group structure in N+1 in which there are as many legal units as there are different activities in the initial production process. While the operation remains unchanged from an economic point of view, four legal units are thus created within group G:

- LeU11 is responsible for the supply of raw materials and resells all its purchases at cost price to a manufacturing company; its NACE code is B (trade);

- LeU12 is an exclusive subcontractor of another industrial legal unit (LeU13) whose activity is the group’s core business, i.e. NACE code A;

- LeU13 sells all of its production to a commercial company within the group (LeU14) responsible for selling the products on the market;

- The main activity of LeU14 is therefore commercial: NACE code C.

The group’s NACE code remains industrial, with such activities creating the most added value. With the simplifying assumption that there is no change in the economic activity of the company between the two years, we arrive at the result shown in Figure 2, although nothing has actually changed in economic terms, with the fact of reasoning in terms of legal units (which have themselves changed) disrupting the statistical landscape.

Figure 1. The simplified description of the flows of a Legal Unit (LeU)

Figure 2. The simplified description of the flows inside a group

Some of the consequences include:

- an increase in turnover from 300 when the legal unit was independent to 800 as a result of intra-group flows without any change in economic activity. This last point can also be observed in terms of added value, which remains unchanged between the two years. Added value is an additive variable that is assumed to be independent of the structure of the units (although this is not the case if we look at the breakdown of added value by sector);

- the creation of new activities (one industrial activity and two commercial activities);

- a change in the sectoral distributions of both turnover and added value.

On the contrary, the fact of considering "the group as a whole" as "an enterprise" results in reverting to the previous situation which, by assumption, has not changed. Implicitly, the example given here highlights the changes brought about by group profiling, specifically:

- the disappearance of secondary activities (internal to the group);

- the reduction in total turnover (and of non-additive variables in general) because of the removal of intra-group flows; this is legitimate insofar as the latter do not respect market rules (the prices used for these exchanges, commonly known as transfer prices, are arbitrarily defined by the group without necessarily being linked to current market prices for the same type of exchanges); therefore, we will now focus on "consolidated" accounts;

- the maintenance of the total level of added value (only its sectoral breakdown is modified).

Based on this observation, it was therefore decided to take into account the notion of group in compiling business statistics using the profiling method. The method essentially covers two entirely distinct activities: the determination of the perimeter of such "enterprises" in terms of legal units and the calculation of statistics on the units thus built.

A top-down approach to defining enterprises in the economic sense

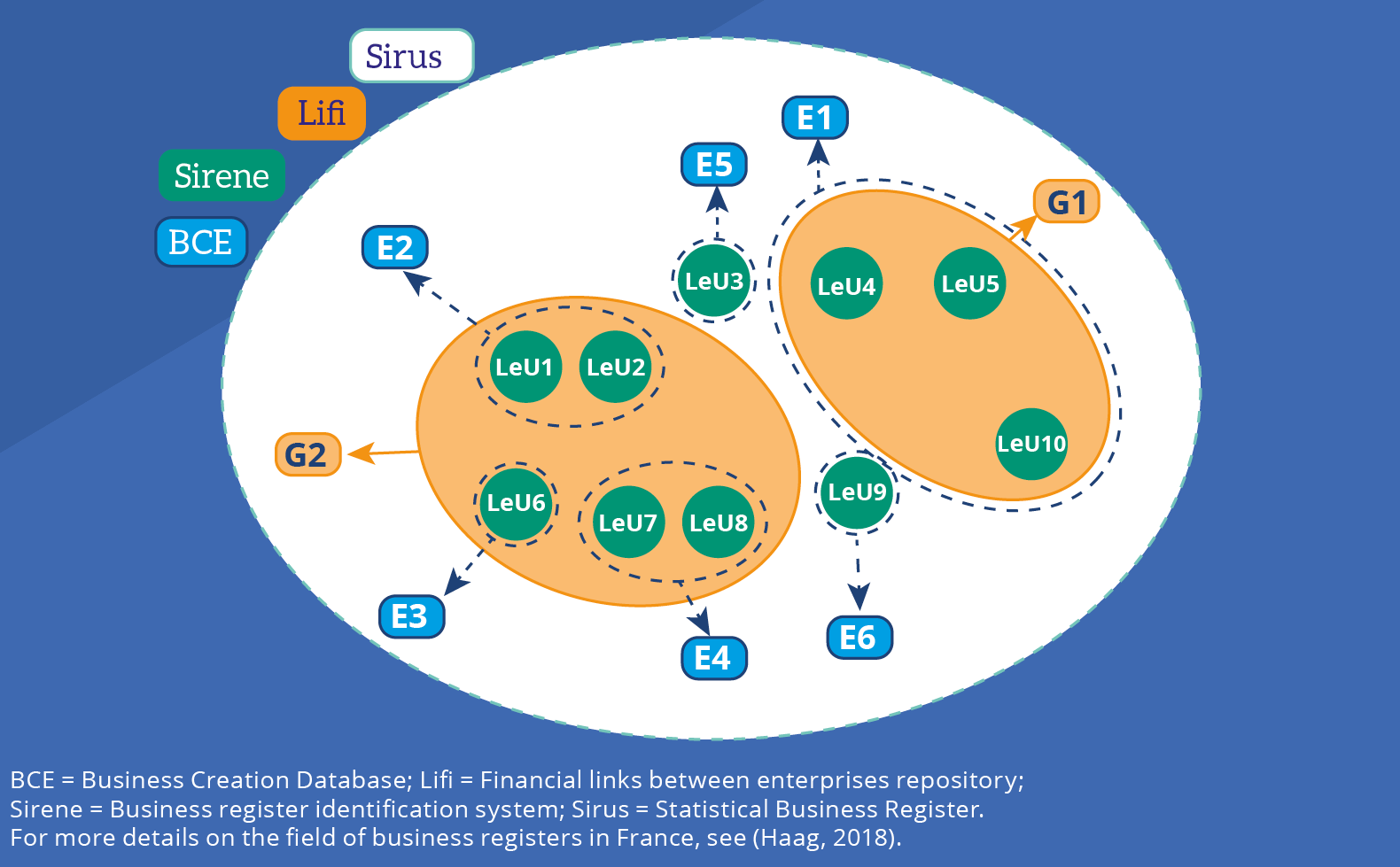

For a given year, the perimeter of these economic enterprises are defined on the basis of the perimeter of the enterprise groups contained in the LIFI (Liaisons Financières, or Financial Links) register (Ouvrir dans un nouvel ongletMariotte, 2017). The profiling of a group begins with the delimitation of one or more enterprises in the economic sense within the group (several in cases where the group is composed of several operational units producing goods and services with a degree of autonomy).

Figure 3 shows the prevailing situation based on a real example involving 10 legal units (LeU1 to LeU10) drawn from the SIRENE register: we find the enterprise groups (G1 and G2) included in the LIFI register based on the financial links between legal units and the enterprises (E1 to E6) created by profilers in the Enterprise Creation Database (Base de création d’entreprise, or BCE).

The national dimension of statistics introduces an additional complexity: compiling statistics requires that a set of legal units in France be considered as an enterprise in France. Therefore, in the case of an enterprise in the economic sense that extends beyond national borders, it is necessary to limit the scope to the latter’s French trace. "French trace" is understood to mean the simple restriction of the activity to the national territory, regardless of the nationality of the owner or owners (e.g. shareholders). Therefore, in France an enterprise in the economic sense will ultimately be:

- a single legal unit not controlled by another legal unit (LeU3 = E5 and LeU9 = E6);

- or the French trace of a group of legal units (G1= E1);

- or part of the French trace of a group of legal units (LeU1 + LeU2 = E2, LeU6 = E3 and LeU7 + LeU8 = E4, with three enterprises forming group G2).

It should be noted that by restricting the scope to the national territory, part of the "autonomy" that is assumed to characterise an enterprise as an economic actor can be lost. This is, in fact, the challenge of the current globalised economy: its operation cannot be accurately described solely on the basis of "national actors". The (national) sets or wholes that are ultimately considered and used to produce national statistics (including GDP) do not present the desired autonomy that typically characterises an "enterprise". However, only a supranational (European or even global) level would allow for truly economically independent actors only to be taken into account. Such is the aim of European profiling. The latter is led by Eurostat, with France acting as a major contributor.

Figure 3. The links between the different types of units and associated repositories

However, it is currently at the experimental stage and to date no statistics have been produced from the "Global Enterprises" (name of the statistical units defined by European profiling).

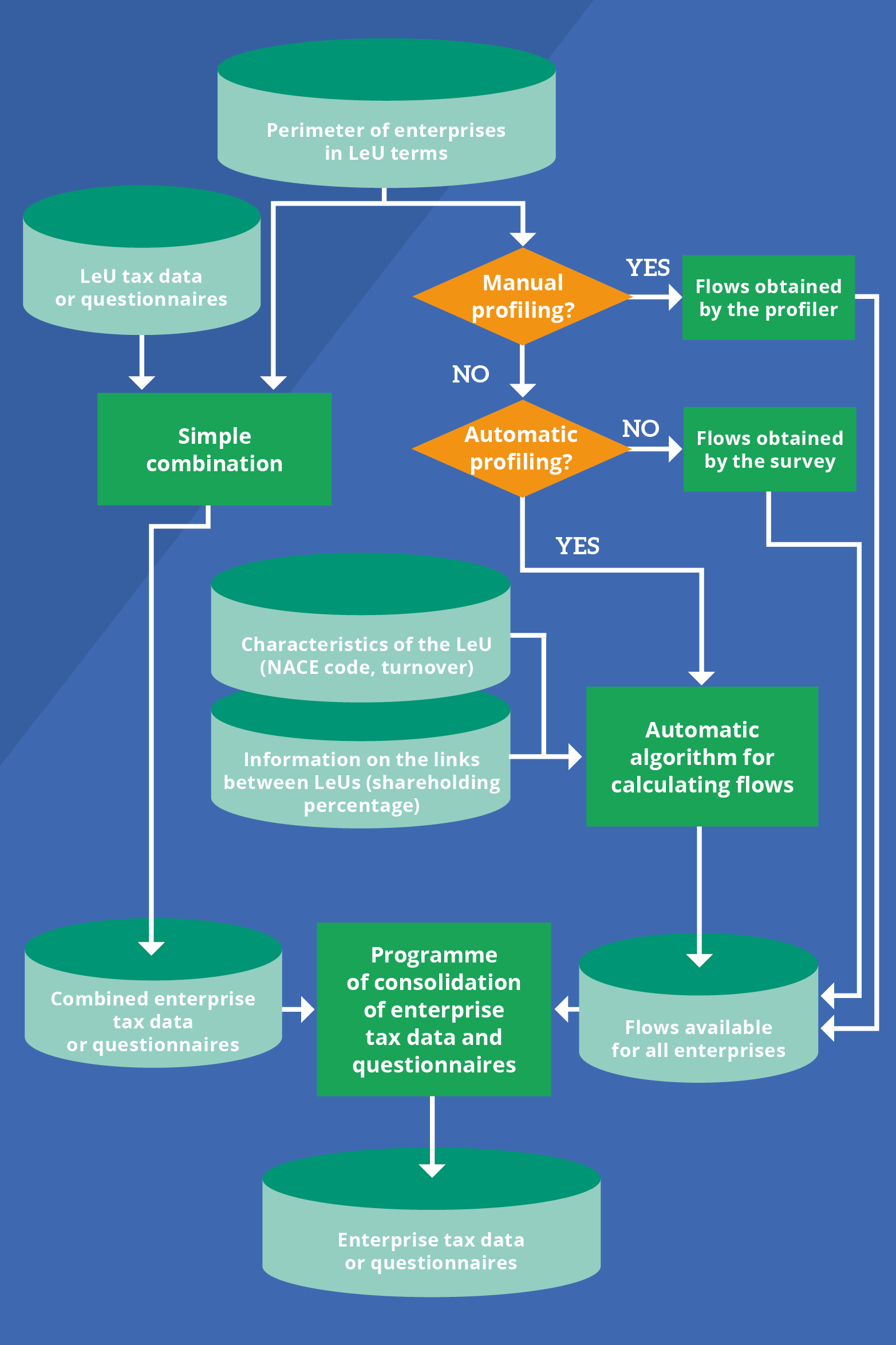

A bottom-up approach to calculating statistics on these new perimeters

In many National Statistical Institutes (NSIs), profiling is limited to this first step of defining and recording perimeters in national registers.

In other NSIs (INSEE, but also the Dutch, Canadian and Australian institutes), profiling is considered meaningful only if it is used to compile structural business statistics. Thus, having identified the perimeters of the enterprise, it is necessary to:

- assign characteristics to it from the statistical business register (identifier, NACE code, category, etc.);

- calculate consolidated data on its scope;

- hold a response from the enterprise for surveys where it has been identified as a statistical unit. This response can be obtained either directly at the level of the enterprise or by aggregating the responses obtained at the level of the legal units that compose it.

Under the ESANE scheme, the method used to calculate the tax and survey characteristics is a bottom-up method (Figure 4). Thus, the observation unit is the legal unit and the values of the characteristics at the enterprise level are obtained by consolidating the data collected at the level of the legal units. However, two scenarios must be distinguished:

- "Additive" variables (workforce, added value, etc.): the value of the variable at the enterprise level is equal to the sum of the values of the variable for all the legal units that make it up. For example, the workforce of the enterprise is the sum of the employees of its legal units;

- "Non-additive" variables (turnover, purchases, receivables, debts, dividends, equity securities): internal enterprise flows must be removed from the combined legal units. Box 2 presents the example of turnover.

Several types of profiling

Different methods can be used, ranging from "manual" profiling, resulting in a group monograph produced by a profiler, to fully automatic profiling, which requires no a priori human intervention. Between these two methods, there are alternative methods – i.e. more or less sophisticated semi-automatic methods.

In France, the results of manual profiling have been taken into account in the calculation of structural statistics (ESANE) since the 2013 financial year published in June 2015. The automatic profiling results first became available for the 2017 financial year published in June 2019.

Figure 4. Description of the Bottom-Up Method

Semi-automatic methods are merely exploratory at present, meaning that manual profiling remains the most advanced method. Today, this concerns around fifty of the largest groups (in terms of added value or employment) present in France. The aim is to reach 70 enterprise groups within the next 3 years. Carried out within a dedicated INSEE unit, manual profiling has led to the development of new working methods and even to a new profession: profiler.

Manual profiling: profiling as a profession

The work of profilers consists mainly in making contact with enterprise groups and meeting with them in order to determine:

- the perimeter of enterprises within the group in terms of legal units,

- the accounting data for these enterprises,

- the response to the Annual Sectoral Survey (in French, enquête sectorielle annuelle, or ESA) for these enterprises.

Once the data have been collected, profilers are required to format, verify and reconcile the information with the data of the legal units they also hold. The validation process is made complex by the number of legal units involved and the difficulty (in some cases) of obtaining reliable data from contact persons from the very first delivery.

These activities – a very new area for INSEE – require specific expertise: the team is therefore made up of a very wide range of profiles, including INSEE "attachés" and administrators, but also contract workers with private sector experience (former accountants, or consolidators, etc.). Experience in accounting and the private sector makes it easier to communicate with enterprise groups by speaking "their language", but also allows for more robust consolidation algorithms to be developed.

Defining perimeters: getting as close as possible to the autonomy criterion

The first activity of the profiler is to identify those subgroups within the enterprise groups that meet the definition of enterprise as set out in the LME. The most difficult concept to understand and which only the group is able to provide with certainty is that of autonomy. However, the autonomy they have is not absolute: a subgroup of companies will only constitute an enterprise if it enjoys a "degree of" autonomy.

INSEE has adopted a set of criteria to objectify the matter. This relative restriction on autonomy echoes the parent company’s ownership of company shares: an enterprise will (almost) never hold intellectual property or long-term financing, nor will it have the ability to decide on heavy investments (at group level), all of which are defining features of the power of a holding company. The autonomy referred to here means the possibility of taking all other decisions, most of which relate to day-to-day management, or in the more or less short term.

Thus, for a subgroup of companies to be able to form an enterprise, it must first have the means to make its own decisions: does it have the necessary staff for its production, trading or service activity? Does it have its own general manager, real estate resources, etc.? It must also form an economically coherent whole and, therefore, a whole capable of operating in an economic environment, and its activity must be primarily market-oriented and not group-oriented. Finally, it is essential that the group be able to provide tax and statistical data on these wholes. Although enterprise groups often hold data in their information systems, they are not always available for the French scope of the subgroup or set out in accordance with the French national accounting code. Therefore, enterprise groups are often required to set up an "ad hoc" information system to meet INSEE’s needs.

The importance of dialogue for obtaining high-quality data

Once the perimeters of the enterprises have been defined, the profiler collects the necessary information from the group in order to create a tax data and a consolidated ESA questionnaire for each of the "enterprises". The profiler must also obtain a set of intra-group flows from the group to be subtracted from the combined legal units of the group for non-additive variables (Box 2).

For tax data, a flow list has been defined. It concerns:

- the income statement (sales v. purchases in particular);

- the balance sheet (receivables v. payables, borrowing v. lending);

- provisions;

- Internal results (dividends-disposals of fixed assets);

- internal equity securities.

For ESA data, the aim is to recover the turnover flow broken down by activities as well as the response to the ESA sectoral questions. This type of information is difficult to retrieve because the profilers’ contact person within the group generally holds a financial position (rather than performing a production role) and therefore does not have access to such information.

In some cases, profilers also play an intermediary role in facilitating the collection of thematic surveys where a response at the enterprise level has been agreed (e.g. ICT and CIS surveys).

Automatic profiling: lower cost, strong hypotheses...

Unlike manual profiling, automatic profiling is not the exclusive responsibility of profilers. Although the unit responsible for profiling manages the definition of perimeters, the analysis of the data resulting from automatic consolidation is carried out by the department in charge of structural business statistics.

The starting point for forming enterprises in the economic sense is the hard core of the group as defined by the LIFI register. It includes all the legal units in which the head of the group holds a stake of more than 50%.

Since it is impossible to assess the autonomy criterion based on an algorithm, it was initially decided, for automatic profiling, to consider the whole group as a single enterprise: this is a strong hypothesis, but a necessary one in practice (Ouvrir dans un nouvel ongletChanteloup, 2017). It was also decided to propose a second hypothesis: to define the perimeters of enterprises, we may limit ourselves to the legal units of the enterprise groups covered by INSEE structural business statistics (ESANE system). Otherwise, the risk would be to introduce inconsistencies, with legal units within coverage belonging to out-of-coverage enterprises and out-of-coverage legal units belonging to within-coverage enterprises – which would have had unfortunate consequences for the statistical apparatus, including double counts that can be difficult to avoid and, conversely, unintentionally excluded units.

The choices made run counter to the pure definition of enterprise: a group may thus be split into several enterprises based on a criterion not directly linked to the European definition of enterprise and, in particular, to decision-making autonomy. However, it has the merit of simplifying the matter and of undoubtedly facilitating the adherence of the actors concerned to automatic profiling. In addition, the practice is currently being implemented for manual profiling. Where possible, profilers group the financial activities of groups within a full-fledged enterprise.

Ultimately, automatically profiled groups are broken down into:

- an enterprise containing all the legal units covered by structural business statistics scope;

- and as many enterprises as there are legal units out of coverage.

... And adapted calculation methods

As with manual profiling, the second phase of automatic profiling involves calculating the characteristics of these enterprises (or rather, in this case, estimating them). Different algorithms adapted according to the variables have been developed:

- The identifier of the enterprise is obtained from a continuity management algorithm based on the number of employees in the legal units.

- The calculation of the NACE code is based on the same algorithm as that used for a legal unit – i.e. based on the breakdown of turnover by activities, but applied to the NACE code and the turnover of all the units. Subsequently, if the enterprise is surveyed as part of ESA, its NACE code will be obtained from the breakdown of its consolidated turnover into activities.

- Additive variables are the simple sum of the corresponding variables in the LeUs.

- The non-additive variables (turnover and its breakdown into activities, purchases, dividends, equity securities, equity, receivables and payables, etc.) result from consolidation algorithms. These variables are affected by possible intra-group trade not valued at market price, which should be eliminated in order to obtain the best possible estimate of economic activity. Therefore, the aim of the algorithm is to estimate the intra-group flows and to remove them from the total of the legal units to obtain the consolidated value of the variable.

An illustrative algorithm is shown in Box 2.

Intermediate-sized groups, intermediate solutions

The decision to restrict the initiative to the 70 largest enterprise groups in manual profiling was made on the basis of the resources available within the unit dedicated to profiling. This entirely arbitrary threshold does not reflect a major split in the hierarchy of enterprise groups in France. In other words the 71st group on French soil has an economic weight very similar to the 70th group. However, while automatic profiling, which is based on relatively crude assumptions, generates satisfactory results on enterprise groups with fairly simple structures, the method is less effective in dealing with more complex structures, the main criticism being to systematically consider the whole group as a single enterprise. This is why work is currently underway to find ways of improving the treatment of intermediate-sized groups, particularly those listed on the stock exchange, at a lower cost than manual profiling.

Such attempts include:

- desk profiling, which involves trying to define enterprises, with no direct interaction with the enterprise groups, based on an examination of the information they publish or that is published about them (e.g. the group’s annual report);

- conducting a test to collect the same flows as those collected by profilers during manual profiling based on a statistical survey of the group;

- taking into account the results of European profiling, allowing for the identification of enterprises at a global level and whose French traces can be considered as national enterprises.

What are the implications for the vision of the economy?

See (Deroyon, 2015), (Ouvrir dans un nouvel ongletHaag, 2016), (Bacheré, 2017) and (Ouvrir dans un nouvel ongletBalcone, Schweitzer, 2018).

Enterprises in manually profiled groups represent around 12% of FTE employees and 16% of the added value of French enterprises. Enterprises from automatically profiled groups account for around 58% of FTE employees and 56% of the added value of French enterprises. The impact of profiling on the results relating to the accounting and financial characteristics of enterprises is therefore significant. The main implications related to the consideration of enterprise in the economic sense are:

- An economy much more focused on large and intermediate-sized enterprises. Where legal units with more than 250 employees accounted for 38% of total employment, 41% of added value and 61% of exports, enterprises of the same size in the economic sense account for 52% of total employment, 57% of added value and 86% of exports. Given this, the validity of the claim that SMEs represent the backbone of the French economy appears to be challenged.

- A sectoral reallocation. Manufacturing gained 3 points in share, increasing from 23 to 26 points, primarily at the expense of services.

- A more realistic vision of enterprise performance. Thus, there is an increase in labour productivity (added value per employee) and average wages for manufacturing, construction and transport enterprises.

The latter two results reflect the fact that for a given enterprise, the results of all the legal units making up the enterprise will contribute to the sector of the enterprise, whereas in the approach based on legal units they contributed to their own sector. In the example of Figure 2, in the corporate vision, the results of the commercial LeU11 contribute to the sector of the enterprise which is industrial, whereas in the legal unit approach its results are recorded in its commercial sector.

- A decrease in total turnover of around 7%, while dividends and share capital fall by around 60%. The effect of consolidation is therefore very significant for the balance sheet variables.

Profiling: a long and unfinished history

The history of profiling at INSEE goes back more than 25 years. The earliest contribution to the field dates back to the early 1990s, with the work of Emmanuel Raulin (Raulin, 1995), though it is also worth noting that at around the same time the 1993 European regulation provided a definition of the notion of enterprise that remains in force today. An in-depth analysis of statistical units and profiling followed, in particular through the study of the Dutch, Canadian and Australian cases, which were already operational. However, at the time, the French approach remained largely theoretical. The first concrete implementations date back to the early 2000s, with the profiling of car construction groups whose results were taken into account in the Annual Business Surveys (in French, Enquêtes Annuelles d’Entreprises). Subsequently, the results of other manually profiled groups were taken into account in the results of ESANE.

2019 marks an important milestone, with the inclusion of all enterprise groups in structural business statistics. Moreover, some areas for improvement are being considered: in addition to current thinking on semi-automatic profiling, further work is underway in order:

- to improve consolidation algorithms by using other information (new variables collected as part of ESA on intra-group flows, use of the consolidated accounts provided by the tax administration on certain enterprise groups);

- to be more effective on office profiling by using web scrapping and textual analysis methods with the aim of extracting useful information more automatically from reference documents, tables of subsidiaries and affiliates and employer declarations.

Moreover, while France remains a key driving force in this area, alongside the Netherlands in Europe and Canada or Australia at the global level, national profiling is beginning to develop in other countries following recommendations made by Eurostat.

On the other hand, European profiling (Ouvrir dans un nouvel ongletXirouchakis, Hecquet, 2018) remains more limited in scope and has yet to move beyond the experimental stage. More than 300 enterprise groups have been profiled, although they are not the largest one. In addition, no statistical results taking into account the enterprises obtained by this work have been published. However, with increasing globalisation and the increasing interdependence of economies, this approach no doubt has a bright future.

Box 1. Definition of Enterprise Within the Meaning of the Law on the Modernisation of the Economy of 4 August 2008

The enterprise is the smallest combination of legal units that is an organizational unit producing goods or services, which benefits from a certain degree of autonomy in decision-making, especially for the allocation of its current resources. An enterprise carries out one or more activities at one or more locations. An enterprise may be a sole legal unit.

Box 2. Consolidation of Turnover

Turnover consolidation is governed by a precautionary principle designed to avoid overconsolidation as far possible. If the distribution in legal units leads to an overestimation of the total turnover (all intra-group turnover is taken into account), it is necessary, on the contrary, to ensure that taking into account the enterprise does not result in an underestimation of the turnover as a result of the mistaken removal of turnover in the automatic consolidation phase.

To meet this assumption, the basic principles governing the algorithm are as follows:

- in case of doubt, when no logical hypothesis is possible, no consolidation is performed since no source on intra-group trade is available.

- when it is assumed that there is a potential trade relation between two legal units within the group, the purchasing capabilities of the unit downstream of the relation and the production capabilities of the upstream unit are consolidated as much as possible (i.e. at least up to these two capabilities). This decision is based on the fact that there is no available source on legal units belonging to a group providing the distinction between intra-group trade and trade transiting via the market.

- The total turnover of the legal units classified as auxiliary is consolidated. It is assumed that these units do not access the market.

The calculation of a consolidated turnover is carried out in successive steps.

- Step 1: for each legal unit, it is determined whether the unit is auxiliary (or intra-group), commercial or productive based on its NACE code.

- The legal units classified as trading units on the basis of their NACE code are considered to be commercial.

- Legal units classified as "holding companies", "head offices" or "other business support activities" and those of any other service sectora are considered to be auxiliary or intra-group units when all LeUs in the group and in this sector account for less than 10% of the group’s employees.

- The other legal units are classified as productive.

- Step 2: Only the turnover of the productive and commercial units is consolidated. To do so, pairs of NACE code that are likely to trade between them were identified and divided into three types of relations:

- Upstream and downstream unitsb. In this case, the turnover (sales) of the upstream legal unit is consolidated as much as possible with the purchases of raw materials of the downstream legal unit.

- Wholesale and retail commercial unitsc. In this case, the turnover of the wholesale trade enterprise is consolidated as much as possible with the purchases of goods made by the legal unit of the retail business.

- Productive units that sell to (buy from) commercial unitsd. In this case, the turnover (purchases of raw materials) of the productive unit is consolidated as much as possible with the purchases (sales) of goods of the commercial unit.

- Step 3: finally, the turnover of the remaining units, i.e. the auxiliary units, is consolidated with the subgroups consolidated in step 2, which already included all the commercial and productive units.

______________________________________________________________________________________________

a. Activities auxiliary to financial services and insurance activities, computer programming, consultancy and related activities, local freight transport by road, continuing adult education, etc.

b. This is a matter of vertical integration, i.e. the production of the upstream legal unit represents an input for the production of the downstream legal unit. One example is a legal unit that manufactures laces and sells its production to a legal unit of the group that manufactures shoes.

c. This is the case, for example, of central procurement services that buy in bulk and resell the goods in the same condition to retailers in the same group.

d. An example is a group that decides to create a specific subsidiary to centralise all its exports.

Paru le :27/06/2019

A group of companies in the statistical sense is a set of legal units generally connected by financial links in such a way that one company within the group (known as the head of group) holds a direct or indirect controlling interest of more than 50% in every company within the group, with the head not being controlled by another company. The head of group may be located abroad.

See (Béguin, Hecquet, 2015) and (Béguin, Hecquet, Lemasson, 2012).

Law on the Modernisation of the Economy of 4 August 2008.

Framework Regulation Integrating Business Statistics.

This is the action taken by members of the NSI (profiler) to define enterprises within enterprise groups and collect data on these units.

The algorithm for calculating the main activity is based on the respective added values generated by the different activities.

The non-additive variables (turnover and its breakdown into branches, purchases, dividends, equity securities, equity, receivables and payables, etc.) result from consolidation algorithms (see below).

In this context, the boundaries are the list of legal units that make up the company.

Which happens if this "enterprise" belongs to a multinational group – a common scenario.

European profiling is based on the same principle as national profiling, with the difference that the trace is European (Xirouchakis, Hecquet, 2018).

See (Willeboordse, 1997), (Brudieu, 1999) and (Hoogsteen, 2016).

See (Pietsch, 1995) and (Rivière, 1999), as well as the website of the Australian NSI ABS: http://www.abs.gov.au/ausstats/abs@.nsf/dossbytitle/AC79D33ED6045E88CA25706E0074E77A?OpenDocument.

See (Smith, 2013).

Annual Business Statistics Programme.

Here, the term "data" refers to tax returns, administrative employment data and responses to statistical surveys.

The Profiling and Treatment of Large Units division (PTGU).

Surveys on Information and Communication Technologies.

Community Innovation Survey.

For example, legal, financial or agricultural units that could continue to be surveyed by the Banque de France or the Statistical Department of the Ministry of Agriculture (SSP) and which would also be taken into account in the results of the enterprise groups to which these legal units belong.

If all services (e.g. Banque de France and SSP) do not take the enterprise into account in compiling their statistics, legal units outside their scope in terms of legal units but within their scope in terms of enterprises would no longer be covered.

See (Deroyon, 2015), (Haag, 2016), (Bacheré, 2017) and (Balcone, Schweitzer, 2018).

Full-time equivalent (FTE).

See also (Willeboordse, 1997), the work carried out by the CBS at the request of Eurostat.

See (Brudieu, 1999) and (Rivière, 1999).

Pour en savoir plus

BACHERÉ, Hervé, 2017. Une forte proportion des emplois créés entre 2009 et 2015 sont portés par les entreprises de taille intermédiaire. In : Les entreprises en France, édition 2017, Insee Références [en ligne]. 7 novembre 2017. pp. 25-34. [Consulté le 4 juin 2019].

BALCONE, Thomas et SCHWEITZER, Camille, 2018. Ouvrir dans un nouvel ongletProfiling : a new way to increase the quality of statistics on research and development. In : European conference on quality in official statistics, Cracovie, 7 mars 2018 [en ligne]. [Consulté le 4 juin 2019].

BÉGUIN, Jean-Marc et HECQUET, Vincent, 2015. Avec la définition économique des entreprises, une meilleure vision du tissu productif. In : Les entreprises en France, édition 2015, Insee Références [en ligne]. [Consulté le 4 juin 2019].

BÉGUIN, Jean-Marc, HECQUET, Vincent et LEMASSON, Julien, 2012. Un tissu productif plus concentré qu’il ne semblait – Nouvelle définition et nouvelles catégories d’entreprises. In : Insee Première [en ligne]. 27 mars 2012. N° 1399. [Consulté le 4 juin 2019].

BRUDIEU, Germaine, 1999. Synthèse sur les pratiques néerlandaise, canadienne et française. In : Des unités statistiques pour représenter l’économie – Approche française et mise en perspective internationale, Insee-Méthodes [en ligne]. Octobre 1999. N° 90, pp. 89-95. [Consulté le 4 juin 2019].

CHANTELOUP, Guillaume, 2017. Ouvrir dans un nouvel ongletCalculation of the automatically profiled enterprises characteristics. In : Meeting of the Group of Experts on Business Registers, Unece, Paris, 27-29 septembre 2017 [en ligne]. [Consulté le 4 juin 2019].

CHANTELOUP, Guillaume, 2018. Consolider les réponses des unités légales pour une statistique d’entreprise plus cohérente. In : Journées de Méthodologie Statistique 2018, Paris, 12-14 juin 2018 [en ligne]. [Consulté le 4 juin 2019].

DEPOUTOT, Raoul, 2008. Ouvrir dans un nouvel ongletRapport du groupe de travail sur les statistiques structurelles fondées sur les groupes d’entreprises et leurs sous-groupes. In : site du CNIS [en ligne]. Janvier 2008. Rapport N° 107. [Consulté le 4 juin 2019].

DEROYON, Julien, 2015. De nouvelles données issues du profilage des groupes : une part accrue de l’industrie, des entreprises plus performantes, mais une capacité à financer l’investissement et un endettement plus dégradés. In : Les entreprises en France, édition 2015, Insee Références [en ligne]. 28 octobre 2015. pp. 39-51. [en ligne] [Consulté le 4 juin 2019].

HAAG, Olivier, 2016. Ouvrir dans un nouvel ongletProfiling : a new and better way to apprehend the globalization. In : European Conference on Quality in Official Statistics, Madrid, 3 juin 2016. [en ligne]. [Consulté le 4 juin 2019].

HAAG, Olivier, 2018. How to improve the quality of the statistics by combining different statistical units. In : The Unit Problem and Other Current Topics in Business Survey Methodology – Edited Proceedings of the European Establishment Statistics – Workshop 2017. Cambridge scholar Publishing – Registration Number : 04333775, pp. 31-46, Editor(s) : Boris Lorenc, Paul A. Smith, Mojca Bavdaž, Gustav Haraldsen, Desislava Nedyalkova, Li-Chun Zhang, Thomas Zimmermann. ISBN (10) 1-5275-1661-X, ISBN (13) 978-1-5275-1661-8.

HOOGSTEEN, Tammy, 2016. Ouvrir dans un nouvel ongletGlobalization and Profiling at Statistics Canada. In : 25th Meeting of the Wiesbaden Group on Business Registers, International Round table on Business Survey Frames, Tokyo, 8–11 novembre 2016 [en ligne]. [Consulté le 4 juin 2019].

MARIOTTE, Henri, 2017. LIFI : Ouvrir dans un nouvel ongletle répertoire français sur les groupes. In : Meeting of the Group of Experts on Business Registers, Unece, Paris, 27-29 septembre 2017 [en ligne]. [Consulté le 4 juin 2019].

PIETSCH, Leon, 1995. Profiling Large Business to define Frame Units. In : COX, Brenda G. et al.. Business Survey Methods. New York, Wiley, 16 février 1995, pp. 101-114. ISBN : 9780471598527.

RAULIN, Emmanuel, 1995. Observer autrement pour mieux représenter. In : Observer et représenter un monde de plus en plus complexe – Un défi pour la statistique d’entreprise, Insee-Méthodes [en ligne]. 12 octobre 1995. N°54, pp. 139-146. [Consulté le 4 juin 2019].

RIVIÈRE, Pascal, 1999, Profilage et unités statistiques en Australie. In : Des unités statistiques pour représenter l’économie – Approche française et mise en perspective internationale, Insee-Méthodes [en ligne]. Octobre 1999. N° 90, pp. 109-117. [Consulté le 4 juin 2019].

SMITH, Paul, 2013. Sampling and Estimation for Business Surveys. In : SNIJKERS, Ger et al.. Designing and conducting business surveys. Wiley, septembre 2013. ISBN-13 : 978-0470903049. ISBN-10 : 047090304X.

WILLEBOORDSE, Ad, 1997. Ouvrir dans un nouvel ongletHandbook on design and implementation of business surveys [en ligne]. Eurostat, octobre 1997. [Consulté le 4 juin 2019].

XIROUCHAKIS, Ioannis et HECQUET, Vincent 2018. Ouvrir dans un nouvel ongletImproving the quality of Business Statistics through Profiling. In : European conference on quality in official statistics, Cracovie, 7 mars 2018 [en ligne]. [Consulté le 4 juin 2019].