The national accounts in 2021 National accounts - 2014 Base

Balance sheet in 2021 National accounts - 2014 Base

This page only presents non-financial balance sheets.

Warning

A new version of the 8201 to 8221 and 8200_2019, 2020, 2021 tables has been published

on October 19, 2022 to correct an error detected in the statistical production process

which affects the previous annual balance sheet on a volume basis published on August 4.

The impact is focused on the year 2021, mainly on flows. Considering the total of

the national economy, the revision is less than 3% in 2021.

In addition, table 8222 has been added.

Annual Balance Sheet

Balance sheet of institutional sectors

Balance sheet and changes in balance sheet of institutional sectors

Gross fixed capital formation (classification of assets)

Pour comprendre

Balance sheet and change in assets accounts

While income and consumption are essential in evaluating standards of living, in the final analysis they can only serve as an appraisal tool when used in conjunction with information about assets. A household that spends its wealth on consumer goods increases its current well-being to the detriment of its future well-being. The consequences of this behaviour are tracked in the balance sheet of this household. The same goes for other economic actors and for the economy as a whole. To draw up balance sheets it is necessary to have comprehensive accounts of assets and liabilities.

The national accounting system serves to give a full description of the flows entering the economy, but also the accumulation that takes place within this economy. It is the balance sheet account and the change in assets account which give a full account of the assets and liabilities in the various sectors of the national economy, supplied each year by the flows in the economy.

The balance sheet accounts are an essential component of any national accounting system. They strengthen overall coherence by providing a comprehensive, balanced, homogenous framework thanks to the use of the same conceptual definitions, the same valuation methods, and the same classifications of sectors and transactions as in the flow accounts. They also extend and enrich the representation of economic phenomena. As such they offer the possibility of testing or verifying the economic theories that establish links between asset variables and behaviours as functions of household consumption and savings, among other things. Overall, the compilation of these accounts considerably adds to the economic data available about a given country, thereby furthering analysis via the inclusion of "stock effects".

Furthermore, whereas flows only capture the creation of wealth from production, stocks link this notion to other sources such as discoveries, inventions, or the variation in value of existing assets and liabilities due to a price change. The "change in assets" accounts use these items to explain the changeover from opening to closing balance sheets over an accounting period:

- Value movements due to production (flows),

- Movements unrelated to production (discoveries, inventions, disasters, etc.),

- Value changes purely linked to price changes.

Economic assets

The concept of assets in the national accounting is based on the notion of ownership. It is defined as the state of assets held and debt contracted by an institutional unit, an institutional sector, or the economy at a whole at a given moment.

Combined with this very general principle are economic notions which serve to specify the dividing line between the assets (in the broad sense of the term) featuring in the balance sheet accounts.

Indeed, according to the ESA 2010 definition, the assets recorded in the balance sheet accounts are economic assets, i.e. assets (which can be tangible or not) upon which ownership rights may be exercised, either individually or collectively, by institutional units and of which the ownership or use over a given period may provide their owners with economic advantages.

"Economic advantages" mean on the one hand the primary income (operating surplus in the event of own use, property income in the event of use by others) derived from use of the asset, and on the other hand the amount that could be obtained in the event of transfer or liquidation, an amount that includes any holding gains or losses. The accounts apply in particular to accumulated market values. The whole set of elements making up assets therefore only includes assets that have been transacted or are likely to be.

This restriction of assets to a market-only definition leads to the exclusion of items that one might expect or wish to see in the accounts (human capital, natural heritage, natural State property, household durables, pension entitlements linked to the allocation system, etc.). However, a simple correlation with the flow accounts requires the adoption of analogous conventions for these accounts and for the balance sheet accounts. As a result, in principle only those items likely to appear in the capital account and the financial account may feature as assets.

Assets and net worth

The balance sheet of any entity at a given date is its net worth, which is defined as the difference in value between all the assets of the entity and all its liabilities at a given date. Indeed in the balance sheet accounts the record is made in terms of assets and liabilities, whereas in the rest of the national accounting system it is made in terms of resources and uses.

tableauTable 1 - Simplified balance sheet account at a given date

| Assets | Liabilities | ||

|---|---|---|---|

| Non-financial assets | NFA | Financial liabilities | FL |

| Financial assets | FA | Net worth | NFA + FA - FL |

| Total assets and net worth | NFA + FA | Total financial liabilities | NFA + FA |

As Table 1 shows, the elements making up the balance sheet account (and the change in assets account), at a given date and for a given entity, are the non-financial or financial assets (corresponding to the assets of the entity in question), the financial liabilities representing the debts of this entity, and the net worth. The financial assets and liabilities come from the current Financial Operations Tables. Table 2 describes the different types of non-financial assets.

tableauTable 2 - The different types of non-financial assets

| Produced assets | Fixed | Tangible | Dwellings, Other civil engineering buildings and structures, Machines and equipment, Weapons systems, Cultivated biological resources |

|---|---|---|---|

| Intangible | Research and Development, Mining prospecting and evaluation, Software, Databases, Original recreational, literary or artistic works | ||

| Inventory | Raw materials and consumables, Works in progress, Finished products, Military stocks, Goods for resale | ||

| Valuables | Precious stones and metals, Antiques and other art objects | ||

| Non-produced assets | Tangible | Land, Ore and energy product reserves, Non-cultivated biological resources, Water reserves, Other natural resources | |

| Intangible | Contracts, leases, licences, Goodwill and other business assets |

Of the items that make up a unit's assets, some do not represent any right to the assets of another unit (non-financial assets) while others do (financial assets). For the relationships between the assets of diverse units (reciprocal nature of receivables and debts) to appear in the accounts, the financial items have to be recorded symmetrically. So each receivable (as defined in the national accounting) is recorded simultaneously and for the same amount in the assets of the creditor unit and in the liabilities of the debtor unit, with the exception of gold and special drawing rights. These two are the only assets that do not act as the counterparty to any liabilities: they are not actually part of their issuers' debt.

For all the resident institutional sectors together (S11 to S15), in an open economy the total amount of financial assets is generally not equal to the total amount of financial liabilities. For the whole set to be complete and balanced, transactions with the rest of the world need to be considered: a global vision of the national assets is obtained by taking into account the financial assets of the rest of the world, i.e. claims on residents and shares issued by resident units held by non-residents, and the financial liabilities of the rest of the world, i.e. claims on non-residents and shares issued by non-residents held by residents. In this way national assets can be seen as the sum of the non-financial assets of all resident units plus financial assets held by resident units on non-resident units, and minus the (financial) liabilities contracted by resident units with non-resident units. This aggregate also corresponds to the sum of net worths of the resident sectors.

As regards financial and non-financial companies, another indicator may be of interest from an analytical viewpoint due to the existence of shares and other equity in their liabilities. For institutional units incorporated as companies, liabilities in the form of shares and other equity are not actually debt towards shareholders or unit-holders, but instead a part of these companies' equity capital. The equity capital is this equal to net worth plus shares and other equity issued.

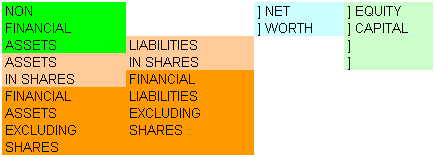

graphiqueTable 3 - Balancing items in the balance sheet accounts

Assets and change in assets

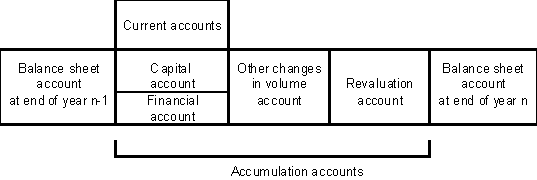

Each balance sheet account, showing the balance at a given date and for a given entity, has its corresponding change in assets accounts. They play a role which is as central as the balance sheet account itself, as they are the point of articulation between the successive balance sheets of the entity in question. They explain the various operations that detail the switch from the previous balance sheet to the balance sheet under consideration, and from that balance sheet to the balance sheet at the following date. Between the start and the end of an accounting period, assets change in composition and in value. These modifications stem from the transactions made in the course of the period (acquisitions - sales of tangible and intangible assets, incurring - extinguishment of debts), and from the changes in value of assets. The link between the opening and closing balance sheets is made by the capital account, the financial account, the other changes in volume of assets account, and the revaluation account, all of which track asset accumulation over the period, fixed capital consumption, and movements not linked to production. These movements trace changes in assets linked not only to discoveries, inventions, disappearances, transformations, transfers and other unforeseen events (other changes in volume account), but also price movements (revaluation account). These are the components that provide the articulation with the flow accounts.

More precisely, the opening and closing balance sheet accounts of an asset are linked together by the following basic accounting equation:

the value of the stock of a given asset in the opening balance sheet account

plus

the total value of the assets acquired minus the total value of the assets sold over the accounting period (non-financial asset transactions being recorded in the capital account and financial asset transactions in the financial account)

minus

fixed capital consumption

plus

the value of other changes in volume - positive or negative - of assets held, with these changes recorded in the other changes in volume of assets account

plus

the value of the nominal holding gains - positive or negative - recorded over the period in the revaluation account, following the changes recorded in price

is equal to

the value of the stock of this asset in the closing balance sheet account.

Therefore, for each asset (or liability) or each group of assets (liabilities), the change between the opening balance sheet account and the closing balance sheet account is the result of all the recordings entered in the accumulation account. The change in net worth is equal to the difference between the total change in assets and the total change in liabilities.

graphiqueTable 4 - Articulation between the flow accounts and the balance sheet accounts

Avertissement

Methodology of the annual accounts

From May 30, 2018, INSEE publishes the national accounts in 2014 base.

The most significant changes concern the national economy's transactions with the rest of the world, as well as the estimations of flows of property income between resident agents (enterprises, households, general government, etc.) as well as between resident agents and the rest of the world.

This basic change is accompanied by some improvements that are described in the " The national accounts switch to 2014 base" folder and in the methodology sheets of the 2014 database.

Online, aids to understanding facilitate the reading of results (definitions, classification, glossary).

Presentation of the transition to the 2014 base of the national accounts

Folder

Sheet