Recovery: so far, so near Economic outlook - May 2021

Overview

Q1 2021: restrained consumption, dynamic investment

At the end of April, INSEE published the first estimate of the national accounts for Q1 2021. Unsurprisingly, the rebound in French GDP was modest (+0.4% compared to Q4 2020, which was itself affected by the second lockdown). Significant health restrictions were already in place in early January, but these were tightened throughout the quarter: the January curfew was brought forward to 6pm, large shopping centres were closed in February, and localised lockdowns put in place in March.

As a result, economic activity deteriorated slightly from month to month, between January 2021 (4% below its pre-crisis level, i.e. that of Q4 2019) and March (5%). Household consumption in particular was held in check by the restrictions, and exports declined. Investment, on the other hand, unlike in previous recessions, did not fall much more than GDP in 2020, and at the start of 2021 it continued the rebound that had begun last summer.

Internationally, figures for Q1 2021 paint a picture of contrasts. At this point, differences between countries at the start of 2021 are probably more a reflection of disparities in terms of the severity and timing of health restrictions than in terms of fiscal stimuli. These restrictions have particularly affected most of the European economies. Meanwhile, the American economy grew strongly, with the gradual easing of health constraints and the sharp rise in household income, while Chinese exports, which have emerged stronger from the crisis, continued to gain market share.

Q2 2021: recovery is so far yet so near

In France, the third national lockdown, from 3 April 2021, limited economic activity in ways that were a little different from what occurred in November during the second lockdown. Travel restrictions were a little less severe, the list of shops able to open was extended slightly; schools, on the other hand, were closed for some time.

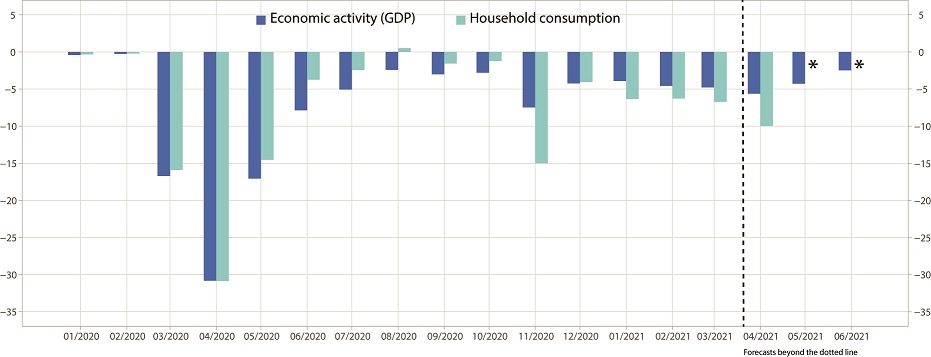

As a result, while high-frequency indicators (aggregated bank card transaction amounts, mobility indicators provided by Google, etc.) fell in April, they did so less than in November: during this third national lockdown, household consumption would appear to have fallen to 10% below its pre-crisis level (against 15% in November 2020 and 31% in April 2020; Graph).

The April business tendency surveys were severely affected in the worst-hit businesses and services, but remained promising overall in industry and building construction. As in November, this lockdown would seem to have affected consumption more than GDP, which nevertheless still appears to have fallen back in April, to 6% below its pre-crisis level (against 7½% in November 2020 and 31% in April 2020).

The decline in the third wave of the epidemic and the escalation of the vaccination campaign have resulted in a timeline being set out for everything to gradually reopen by the end of June. This reopening could bring economic activity back up to around 4% below its pre-crisis level in May, then to –2½% in June. Given these assumptions, GDP would increase hardly at all in Q2, by about +¼% compared to the previous quarter. Thus in Q2 it is likely to be around 4% below its pre-crisis level with the annual growth overhang expected to be +4¼% in mid-2021.

At the lowest point of the 2008-2009 great recession, French GDP also fell to around 4% below its pre-crisis level, which gives an indication of the scale of the current crisis. In some sectors, the health restrictions have automatically brought activity down far below its usual level. However, in those countries where vaccination campaigns have been successfully rolled out they seem to be accompanied by a distinct upturn in activity and especially in household consumption. The very singular nature of this economic crisis stems directly from the health crisis: each epidemic wave has resulted in a sudden and large-scale drop in activity, but these can be followed by a sharp rebound once constraints are lifted and if the epidemic remains in check, especially with household income and the productive fabric having been largely preserved by massive support mechanisms.

graphiqueMonthly estimates and forecasts of GDP and household consumptiondifference compared to Q4 2019, in %

- * GDP projected until June 2021 but household consumption only estimated for April 2021.

- Source: INSEE calculation and forcast

Impact of health measures on productivity, tensions around supply provision: some questions about recovery

While the frame of reference for the outlook for the coming months remains essentially health-related, several questions of a more economic nature nevertheless arise in the light of recent results, presented here, from INSEE’s business tendency surveys of companies.

The crisis has affected different sectors of activity in very contrasting ways. While some of these contrasts will certainly be assimilated, some sectors will not necessarily return to their pre-crisis level. Conversely, others will undoubtedly forge ahead in the long term (IT, etc.), and outrun the health crisis. This reshaping of sectors and between companies in the same sector is likely to affect potential GDP. At the same time, total factor productivity may also change, for example as a result of increased teleworking and the digitization of certain tasks. The crisis has seen to it that some of these movements accelerate. In the April 2021 business tendency surveys, almost one in two companies reported that health protection measures (preventive measures, possible reorganisations and/or teleworking) had a negative impact on their productivity. Regarding teleworking more specifically, 20% considered that it had an unfavourable effect, but 11% were of the opposite opinion, which leaves open the question of the associated productivity gains when this mode of work is no longer imposed.

Again according to the April 2021 business tendency surveys, more and more companies in industry, building construction and, to a lesser extent, services are experiencing supply-related difficulties that are holding back their activity. For example, 30% of industrial companies and 41% of building construction companies say they are facing only supply difficulties. In particular, tensions over sourcing are increasing. Reflecting the rebound in world trade, commodity prices are accelerating, as are production prices in French industry (+4% over one year in March 2021, however, this figure should be qualified in the light of the low level of these indices in spring 2020). This movement is likely to lead to both a compression of corporate margins and a rise, at least for a time, in consumer prices.