Courrier des statistiques N1 - 2018

The Legal Entity Identifier International Context and Role of INSEE

The willingness to create a worldwide system of unique identifier for the financial markets was strengthened by the 2007 crisis. Launched by the G20 in 2011, the Legal Entity Identifier (LEI) initiative took concrete form with the introduction of a global directory that could serve as a common reference base at the end of 2012 – beginning of 2013. Since then, LEI codes have been used internationally for the reporting obligations of entities carrying out transactions on derivative instruments applied in the United States and Europe. In France, as early as 2013, INSEE was put forward by the Ministry of the Economy and Finance to be the local issuer of the LEI, because of its experience in managing registers and identifiers. It was confirmed in this role in 2018 when it was accredited by the Global LEI Foundation (GLEIF). The second stage in the initiative, launched mid-2017, consists of completing the identification data of the applicants for an LEI with those of their direct and ultimate parent. These so-called “level 2” data bring significant improvements in the knowledge of the composition of groups, their financial footing and potentially their strategy.

- A strong political mandate born of the financial crisis

- Ambitious objectives

- A system based on self-registration by declarants

- A decentralised organisation, demanding coordination

- Towards a global system of legal entity identification

- INSEE, an exception in the LOU world

- An operational system at international level

- FRANCE ranked 7th lei issuer

- An activity in its own right for INSEE

- Development prospects of interest to statisticians

A strong political mandate born of the financial crisis

The academic world, regulators and supervisory bodies, as well as the financial industry had long been debating the advantages and attractions of an international codification system enabling a unique identification of legal entities. The 2007 crisis accelerated the Legal Entity Identifier (LEI) initiative.

The foundation stone was laid at the G20 summit in Cannes in November 2011. The leaders of the G20 thus entrusted the Financial Stability Board (FSB) with the task of putting forward recommendations to enable the development of a global LEI.

“We support the creation of a global legal entity identifier (LEI) which uniquely identifies parties to financial transactions. We call on the FSB to take the lead in helping coordinate work among the regulatory community to prepare recommendations for the appropriate governance framework, representing the public interest, for such a global LEI by our next Summit.” (G20 Summit Final Declaration, 2011)

Initially, a group of experts set up under the auspices of the FSB and involving representatives of the central banks, ministries of finance and supervisory authorities defined the target architecture, laid down the main principles of governance and clarified the method of financing the plan. This Expert Group drew up a set of 35 recommendations (FSB report, 2012), which would serve as the founding principles of the initiative, approved by the G20 leaders at the Los Cabos summit in June 2012.

“We endorse the FSB recommendations regarding the framework for development of a global legal entity identifier (LEI) system for parties to financial transactions, with a global governance framework representing the public interest. The LEI system will be launched by March 2013.” (G20 Declaration, June 2012).

From this stage on, the foundations were laid that would enable the development of the LEI initiative. It was thus asserted that an association with the private sector was essential to its success; the Expert Group thus benefited from interaction with the representatives of the financial industry in the form of workshops or continuous interactive exchanges. Establishing that a global identification system is for the public good, the Expert Group sketched out the main organisational principles of the initiative: transparency and free access to information, financial independence of the central agency managing the system, thereby shielding it from the risk of dependency on interest groups, political neutrality, etc.

The Expert Group made way for a group tasked with the operational implementation of the recommendations, which laid the foundations of the initiative between June 2012 and December 2012. In particular, the legal framework rested on a Charter (November 2012) opened for signature by the authorities of all the interested countries, after approval by the FSB (5th progress note) and the G20 (G20 Communiqué, November 2012). This Charter set out the target architecture: a central agency, the Central Operating Unit (COU), a network of Local Operating Units (LOUs), a Regulatory Oversight Committee (ROC) and a Committee on Evaluation and Standards (CES).

Ambitious objectives

Born of reflections undertaken after the 2007 subprime mortgage crisis, the LEI initiative was intended to be very ambitious from the outset: a global dimension, accelerated implementation, a wide scope (the LEI potentially concerns every legal entity liable to engage in financial transactions) and multiple potential uses.

The initiative was in fact marked by its origins and the taking into account of the requirements for macro and micro-prudential supervision.

Improving the identification of the parties to transactions allows better management of the risk-taking by the actors involved, thereby favouring a more effective allocation of risks within the global financial system. A standardised framework for the identification of the participants in the financial markets provides bases for collecting information on individual positions and therefore better assessing exposure to risk both at individual level and in the overall system. The basis of this collection is the obligation placed on entities wishing to intervene on the financial markets to request an LEI.

In the past, although the potential benefits of a better identification system were recognised by all, progress in this area had traditionally been limited by two main factors:

- Firstly, the existing declaration systems, constructed in response to essentially local needs, were largely integrated into operational processes. In fact, change would potentially be very costly.

- Secondly, the incentives to reform these local systems were too limited for the individual actors, thus illustrating a classic problem in collective action and the need to take the first step.

The financial crisis that occurred in the developed economies in 2007 prompted the collective awareness of the need to act and the necessity for the public and private sectors to work together to resolve the issues inherent in collective action.

The introduction of a global directory that could serve as a common reference base was the first step in the initiative (end of 2012 – beginning of 2013). The second stage, launched mid-2017, consisted of using this base to better address the relations between the different entities and set up a system of identification of the connections between legal entities to establish a mapping of groups of companies and financial institutions. These so-called “level 2” data significantly contribute to improving knowledge of the composition of groups, their financial footing and potentially their strategy. Collection began mid-2017 with companies that have or are applying for an LEI.

A system based on self-registration by declarants

The first step in the initiative therefore consists of allocating an identifier (LEI), which provides the applicant with a unique and exclusive identification. The strategy followed is very pragmatic, taking both a legal approach and a statistical one. Both a directory and an authoritative repository, the LEI database offers a legal and statistical foundation which rests on the same need to define the object dealt with (in particular the notion of legal entity).

The applicant can be a financial institution, a non-financial corporation, a fund and, more generally, any entity with a legal personality that is a party to a financial transaction subject to regulatory reporting. Funds without a legal personality but subject to European regulations on derivatives (European Market Infrastructure Regulation or EMIR, July 2012), to the reporting requirements defined by the American Dodd Frank Law or to any other reporting requirement also have the possibility of obtaining an LEI and therefore being authorised to operate on the financial markets.

Physical persons are not authorised to obtain an LEI, in particular for reasons connected to personal data protection (the information entered by applicants is freely accessible). For all that, the question remains for individuals carrying on a professional activity in a self-employed capacity and more generally for the multiple legal versions of the notion of the one-man business that exist around the world.

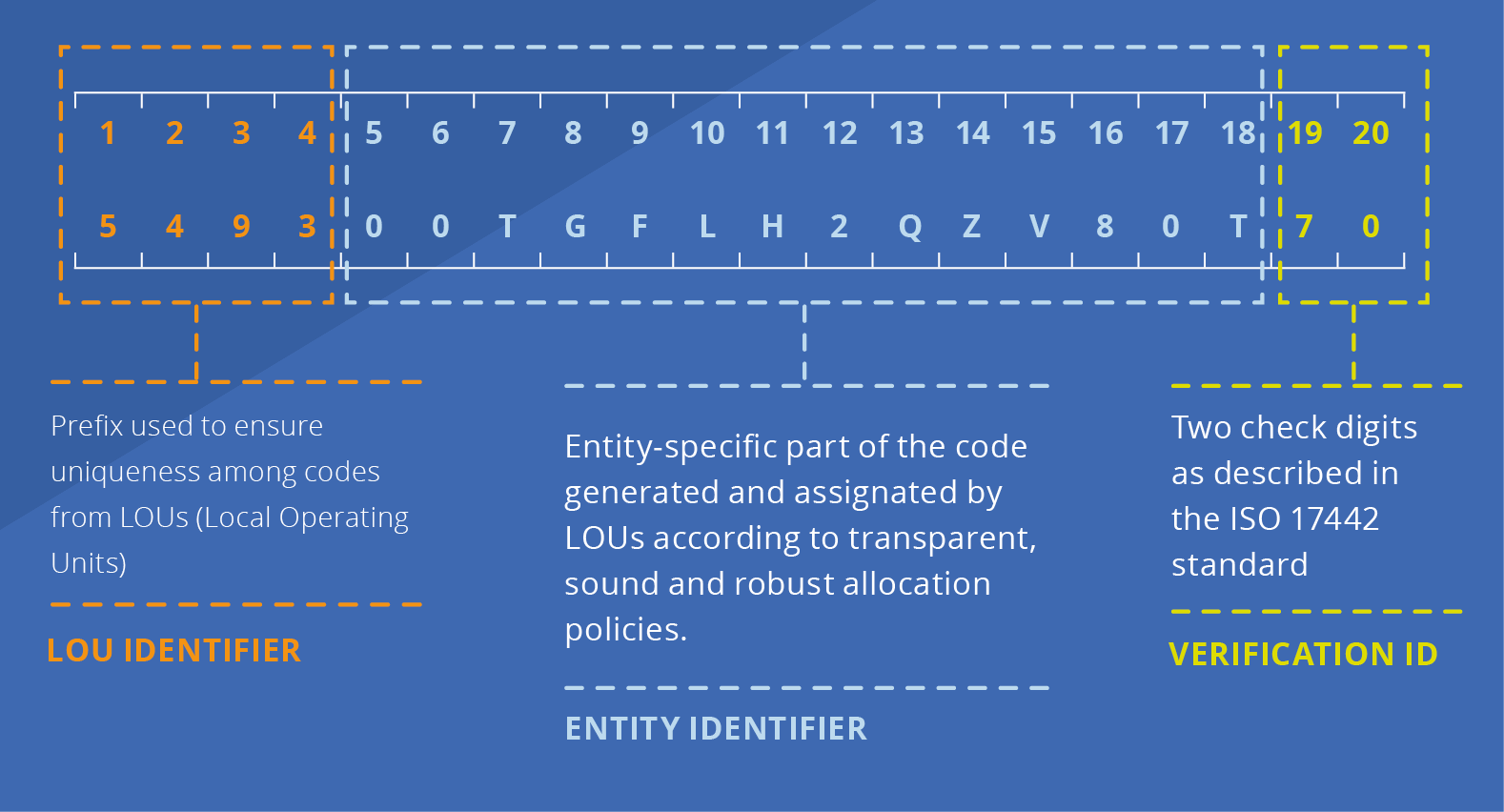

Whatever the legal status of the entity, the LEI assigned to it is a 20-character alphanumeric string compliant with the ISO 17442 identification standard of the International Standards Organisation, which does not contain any information on the applicant or the entity (Graph 1).

Graph 1. The LEI code

Each code is associated with reference data identifying the legal entity (so-called “level 1” data) such as the name of the entity, the company's address and registration number in the local trade register (in France, each LEI is associate with a unique registration number in the SIRENE business register).

The system is based on self-registration, which means that the applicant is the first person responsible for the quality of the data associated with the LEI. The LOUs allocating LEIs, however, do have a duty to validate the data declared (for example using the local register) and the control procedures are subject to verification by the COU.

The system is funded, on the cost recovery principle, by the registration fee and the annual maintenance fee paid to the LOU by the entities registering with it. The LOUs in turn pay a contribution fee to GLEIF (see below) calculated on the number of LEIs they manage (17 USD per LEI in 2018). The cost recovery principle allows the costs for entities registering to be contained or gradually lowered.

A decentralised organisation, demanding coordination

The setting up of a decentralised network of LOU required coordination and harmonisation of practices, in particular in terms of data quality. This was done initially by the public authorities in charge of supervising the system via standards applicable in the system. Since June 2014, this coordination has been provided by a foundation established under Swiss law, the Global LEI Foundation (GLEIF) created specially for the purpose. The GLEIF is also in charge of ensuring compliance with the standards it has defined, as well as the process of accrediting LEI issuers, the LOUs.

Thus, each LOU issuing LEIs must prove its ability to make available to the public (and other issuers), every day, a standardised file of the LEI codes issued locally and the information associated with them, in particular to allow centralisation of the LEIs issued and avoid the creation of duplicates. It is also responsible for disseminating these data as open data, so that they can be used more widely.

Such a procedure implies first of all being able to manage globally the multiple languages used locally and each entity must provide a Romanised version of the local name. This transliteration combined with a unique code is a first and strong guarantee against the duplication of codes.

The attention paid to the quality of the collected data is one of the elements that is inspired by the statistical approach. The principle of transparency and access free of charge to the information as open data makes it possible to include users in the system of evaluating the quality of the data, everyone being able to “challenge” the information used with the LOUs and ask for data to be updated or corrected.

Towards a global system of legal entity identification

Six years after the Los Cabos Summit which marked the beginning of the operational reflection on the implementation of the LEI, the outcomes are more than encouraging.

At the beginning of 2013, the authorities that had signed the Charter met for the first time in Toronto for a Regulatory Oversight Committee (ROC) meeting. The Committee, which is the decision-making body and which is responsible for the governance of the system in the public interest, is open to all the authorities signing the Charter. By the middle of 2013, the ROC had 53 member authorities and 19 observers. Today it has 72 member authorities (including 28 from the European Union) and 18 observers.

The use of the LEI has developed as a result of a proactive commitment on the part of the public authorities. Obtaining an LEI for entities operating on the financial market was made obligatory first for derivatives by the Dodd Frank Law in the United States, as of February 2013, and by the EMIR Regulation in Europe as of February 2014. In addition, the European Banking Authority imposed the LEI in the context of the reporting requirements, and was quickly followed by the European Insurance and Occupational Pensions Authority (EIOPA). In France, Instruction 2013-I-16 of the ACPR (Prudential Supervisory and Resolution Authority) made obtaining an LEI mandatory for all organisations under its authority (credit institutions, investment companies, etc.). And since January 2018, the revision of the European Directive on markets in financial instruments (MIF2) has extended the scope of the transactions on financial instruments requiring the obtaining of an LEI. Outside the European Union, more and more regulations are also imposing the LEI.

The ROC member authorities have laid the foundations for the success of the initiative by guaranteeing holders of an LEI the possibility of using their identifier in their jurisdiction. Any LEI issued by an accredited LOU can be accepted for the reporting obligations imposed by the ROC member authorities.

INSEE, an exception in the LOU world

At the beginning of 2015, 31 LOUs had already been sponsored by the members of the ROC, but only 22 were operational. In France, from February 2013 onwards, INSEE was designated by the Ministry of the Economy and Finances to be the local operating unit for entities under French law (that is to say for the French jurisdiction): funds registered with the AMF (Autorité des Marchés Financiers), the French Financial Markets Authority and legal entities registered in the SIRENE business register. This decision was justified by:

- the Institute's know-how in the management of registers and identifiers (SIRENE), and therefore its ability to rapidly set up the relevant IT infrastructure;

- proximity with the SIRENE business register, to check the existence and identity information of the entities applying;

- the French authorities' concern to be actively involved in the implementation of this global initiative;

- the desire to avoid the costs for French economic entities being too high.

The interest for INSEE was twofold:

- the guarantee of continuing to play a leading role in the processes of identifying French economic entities (and keeping control over the bridge table between the LEI and SIREN identifiers);

- the financial contribution this activity would bring to INSEE's budget; it is in fact permitted to make a profit on this activity, useful given the fact that the SIRENE data will be free of charge.

In 2015, GLEIF set up a procedure for accrediting the LOUs to replace sponsoring by the financial authorities. A guarantee of an increase in and harmonisation of the quality of the collected data, this procedure was imposed on all the LOUs already in operation as well as new organisations wishing to become LEI issuers. By mid-2018, the GLEIF had accredited 32 LOUs including INSEE (in January 2018). INSEE is a LOU, but its status as a government entity has no effect on the resulting activity.

It should be noted that, with some exceptions, the national statistical institutes do not generally manage the registers of companies. Most LOUs are private operators. They do not have a monopoly for a given region and each applicant has the possibility of choosing the operator that will issue and maintain its LEI. In certain countries there can be several LOUs (Germany, United States, among others). Nevertheless, not all LOUs are accredited to operate in all jurisdictions, either by choice or due to difficulties in accessing certain registers of companies or funds. To date, only 10 LOUs are accredited to operate in the French jurisdiction. The accreditation is renewed annually.

An operational system at international level

By the end of September 2018, over 1,280,000 LEIs had been issued for entities situated in 223 countries, including almost 920,000 in Europe. If we focus on valid LEIs (that is to say issued, certified and active) at global level, there are 1,045, 000, including almost 766,000 in Europe. The list of all the LEI issued, which is updated on a daily basis, is free to access on the Ouvrir dans un nouvel ongletGLEIF website.

The main developed and emerging countries are involved in the initiative, but the geographical distribution of the codes issued remains uneven. Most of the codes issued correspond to European and North American entities. This is connected, in part, to the geographical distribution of the operators on the financial markets, but also to different regulatory calendars. The LEI fits in naturally with a European agenda of ever deeper integration in the financial sphere, but in the United States it is more dependent on the strategies of the agencies in charge of financial regulation. The accreditation of Chinese, Korean and Japanese LOUs means that the delay observed in Asia is being caught up, but it emphasises even more the low penetration of the LEI in Latin America. It is notable that financial centres such as Luxembourg, the Cayman Islands, the Virgin Islands, Hong Kong or Singapore have a significant number of LEIs registered. Finally, Africa, traditionally far removed from initiatives in the financial field, has been involved, although admittedly to a modest extent, in the development of the LEI. Four countries (South Africa, Angola, Nigeria and Mauritius) have signed the ROC Charter.

FRANCE ranked 7th lei issuer

By the end of September 2018, France was ranked 7th in terms of the number of LEIs issued (approximately 69,000, of which 54,000 have been validated), the vast majority of them issued by INSEE (about 62,800, of which 49,400 have been validated), which places INSEE in eighth position among LEI issuers. The French system, based on linking the LOU to the SIRENE business register, which includes the trade register and the AMF's register of funds, was for a long time a special case. Although it allows the highest level of quality to be achieved (any change in identification data is passed on to the corresponding LEIs almost immediately), it can only be applied to legal entities under French law registered in INSEE's SIRENE database and to funds subject to French law registered with or declared to the AMF. Other LOUs have opted, like INSEE, to operate only with entities in their own jurisdictions. To date, there are nine of them in addition to INSEE. They are mainly chambers of commerce or the issuers of the national unique entity identifier in their jurisdiction.

As a result of the implementation of the MIF2 Directive announced for January 3rd 2018, the number of applications for the creation and renewal of LEI has increased substantially since summer 2017, peaking in December 2017 and January 2018 before dropping off from February 2018, whilst nonetheless remaining at a higher level than before (Graph 2).

Graph 2. Monthly creations and renewals of LEIs by INSEE from January 2017 to September 2018

Indeed, until May 2017, the number of new LEIs allocated (created) by INSEE every month was between 200 and 350. In June, July and August 2017, it was more like 400 to 500. Then, as the effective implementation of MiFID2 approached, it leapt up to reach 5,700 in December 2017 and exceeded 6,400 in January 2018 before falling back to somewhere around 3,000 in February and March 2018, about 1,500 in July 2018, to reach just over 800 in September 2018.

As a result, by the end of September 2018, the stock of validated LEIs being managed by INSEE had reached almost three times its level one year earlier, with 48,948 validated LEIs, including 40,775 companies and 7,786 funds.

Although, quite naturally, when the initiative first started up funds constituted the largest population of LEIs registered by INSEE (about 40% at the beginning of 2015 and still 38% in June 2017), they represented only 16% of the LEIs issued after the implementation of the MIF2 Directive (Table 1).

tableauTable 1. distribution by type of entity

| Number of LEIs validated | Funds | Companies | Total |

|---|---|---|---|

| End June 2017 | 6,568 | 10,729 | 17,297 |

| Distribution | 38% | 62% | 100% |

| End June 2018 | 7,786 | 41,162 | 48,948 |

| Distribution | 16% | 84% | 100% |

The number of companies among the validated LEIs issued by INSEE almost quadrupled between the end of June 2017 and the end of September 2018 and the characteristics of the entities concerned changed. There are more companies not belonging to a group (54% at the end of September 2018, compared to 35% at the end of June 2017). With regard to the categories of enterprises defined by the French Economic Modernisation Act (LME) of 2008, the shares of Large Enterprises (LEs) and Intermediate-Sized Enterprises (ISEs) fell in favour of Small and Medium-sized Enterprises (SMEs), and, more particularly, Micro-Enterprises (MEs) (Table 2).

tableauTable 2. Distribution of company LEIs by category of enterprise under the LME

| Category of enterprise under the LME* | End Sept. 2018 | End June 2017 |

|---|---|---|

| Large enterprises (LEs) | 6% | 17% |

| Intermediate-sized enterprises (ISEs) | 13% | 22% |

| Small and medium-sized enterprises (SMEs) | 81% | 61% |

| - Micro-enterprises (MEs) | 47% | 22% |

| - Small and medium-sized enterprises (SMEs) excl. MEs | 33% | 39% |

| Total | 100% | 100% |

- * LME is the French Law on the Modernisation of the Economy of the 4th of August 2008.

Similarly, with regard to turnover and size of workforce, it is also the share of the smaller enterprises that has grown. Indeed, by the end of September 2018 more than half (63%) of companies with a validated LEI had a turnover of under €1 million, whereas this figure was only 30% at the end of June 2017. And 62% of those registered by the end of September 2018 had less than 5 employees on 31 December 2015 compared to 48% of those registered by the end of June 2017.

The application of the MiFID2 regulations also led to a change in the sectorial distribution of companies with a validated LEI. Although the financial and insurance activities sector remained at the top of the list, maintaining its share of 26%, wholesale and retail trade and repair services of motor vehicles and motorcycles saw its share fall from 23% to 14% between June 2017 and September 2018, falling back to 3rd position after real estate activities, which rose into 2nd position with a 16% share compared to 14% in June 2017. The specialised professional, scientific and technical activities sector, for its part, remained in 4th position, almost doubling its share to reach 13%.

By the end of September 2018, just under 1% of the total number of companies in the productive market sector had an LEI. After weighting by workforce, these companies account for 11% of the workforce in the productive market sector, and after weighting by turnover, 16% of the total turnover of the productive market sector.

An activity in its own right for INSEE

INSEE began to allocate LEIs in July 2013, with the opening of the website https://lei-france.insee.fr. Since July 2014, this site has enabled applicants to carry out certification and renewal online using a login and password, as well as to pay the related fees online. It also contains the files of LEIs issued by INSEE accessible as open data. As well as managing the registers (allocation of identifiers without duplicates, validation of data declared, etc.), the activity of an LEI issuer also includes non-negligible components involving responding to enquiries and billing. All of this also requires, of course, specification and IT development work, as well as very close relations with GLEIF and a high level of responsiveness in taking into account the changes dealt with at global level.

For its implementation, INSEE relied on internal and external resources. In accordance with GLEIF's requirements, in January 2013 INSEE set up a unit dedicated to its activity as a LOU issuing LEIs. This unit, situated within the division that manages the SIRENE business register, is attached to the Business Statistics Directorate. It manages the LEI application, which consists of the website and a set of processing operations used in particular to allocate the LEIs and to validate the reference data by matching with the SIRENE business register managed by INSEE and the register of funds managed by the AMF. It ensures these data are updated in the event of changes in the information held in the reference files. In addition, it has the budgetary and accounting tools necessary to:

- calculate its costs, direct and indirect, in order to be able to justify them to GLEIF;

- produce budget forecasts over a sliding three-year period allowing the fee schedule for its services to be determined (issuing and renewal of LEIs) for the coming year.

Externally, INSEE can draw on the competencies and resources of Banque de France, the AMF, the Treasury (Directorate General), all three of these financial authorities being members of the ROC (and a member of the ROC's Executive Committee for Banque de France).

Development prospects of interest to statisticians

Until now, the initiative has been guided mainly by micro and macro-prudential concerns. In the countries that have already imposed the use of the LEI, the entities identified are consistently in favour of extending the LEI to other usages. Furthermore, the authorities that have not yet integrated the use of the LEI into their supervision system, will be able to learn from the successful examples of regulatory implementation (Dodd Frank Law, EMIR and MiFID2 regulations). Finally, the progressive geographical extension is continuing and should mechanically increase the number of LEIs issued.

Although ambitious and multiple, the objectives set out by the Expert Group and included in the Charter only make limited reference to the initiative's contributions in terms of statistics, which constitute a natural area of development.

Indeed, the objectives on improving risk management largely overlap with the statistical concerns. There are in fact, three dimensions where there is a definite bond between the statisticians' objectives and risk management:

- the identification of entities;

- the classification of financial instruments;

- the identification of transactions.

The LEI was aimed, at the beginning, mainly at the first aspect, and already it can facilitate the production of statistics by offering a reference base for the identification of the parties to financial transactions. Completed by a national accounting sector code, it can be used to provide an attachment matrix for the entities that could be made available to reporters of statistics (essentially the banks). Along the same lines, the identification on non-financial agents among the money supply counterparts would be facilitated and the identification of cross-border transactions in the balances of payments easier. Generally, the LEI can be used as a basis for a statistical reference system that allows an easier passage from individual data to aggregated statistics. In a context where statistics are drawing more and more often on granular data, the LEI is looking like an important factor this development.

The second phase in the LEI launched in mid-2017 (the declaration of direct and ultimate parents within the meaning of accounting consolidation and financial links) should also enable the mapping of groups of companies by all the public and private actors (and complete what has been already done by INSEE with the LIFI register of financial links). It also confirms the role of the LEI as a statistical tool and object of study and research. Already, there are lessons to be learned from the analysis of the geographical dispersion of LEIs about the integration in the global economy of certain geographical zones. In the future, analysing the structure of groups and how they change will enable an area of research to be extended that is currently insufficiently explored.

Paru le :06/12/2018

This accreditation was confirmed in particular after an audit of the INSEE General Inspectorate conducted in 2017, as provided for under the framework agreement signed with GLEIF.

For INSEE, the registration fee is €70 (€50 for annual certification). These amounts were fixed by an Order dated June 28th 2013 (published in the JORF (French official gazette) on July 6th 2013), amended on June 1st 2018.

At the end of September 2018, out of the 1,280,000 LEIs issued, 920,000 were issued in the European Union, 170,000 in the United States, 86,000 in “financial centres/tax havens” and 7,500 in Japan.

Pour en savoir plus

G20 Summit, “Final Declaration”, November 4th 2011.

FSB, “Report Global Legal Entity Identifier for Financial Markets”, June 8th 2012.

G20 Summit, “Leaders' Declaration”, June 18-19th 2012.

FSB, “Charter of the Regulatory Oversight Committee for the Global Legal Entity Identifier (LEI) System”, November 5th 2012.

FSB, “Fifth progress note on the Global LEI Initiative”, January 11th 2013.

G20 Summit, “Final Communiqué, Meeting of Finance Ministers and Central Bank Governors”, November 4-5th 2012.

Regulation (EU) N°648/2012 of the European Parliament and of the Council of July 4th 2012 on OTC derivatives, central counterparties and trade repositories Text with EEA relevance.