Economie et Statistique / Economics and Statistics n° 503-504 - 2018 What Drives Non-Financial Sector Borrowing in Emerging Market Economies?

THE ARTICLE ON ONE PAGE

Key question

The last decade has been characterised by a considerable increase in private non-financial sector (NFS) indebtedness all over the world. In emerging market economies (EMEs) this raises concerns as the large majority of previous financial crises have been preceded by rapid leverage growth, and the buildup of corporate leverage has often been associated with boom-bust cycles and financial turbulences. In a context of economic slowdown, the US monetary policy tightening and associated more restrictive global funding conditions raises questions on the potential risk of financial instability in EMEs in the near future.

Methodology

The local and global drivers of private NFS borrowing (from all sectors, domestic banks and/or from abroad) are estimated for a sample of 15 emerging economies over the period 1993-2014 through the feasible general least squares technique, to account for the heteroskedastic error structure between panels and panel-specific autocorrelation.

Main results

The increase in private NFS borrowing in EMEs is found to have been associated with an increase in the demand of credit, the appreciation of domestic currency, reduced macroeconomic vulnerabilities, a healthy and large domestic banking system. Among the global determining factors, the appreciation of the US dollar, the high global financial market volatility and the US monetary policy stance are equally found to have had an influence.

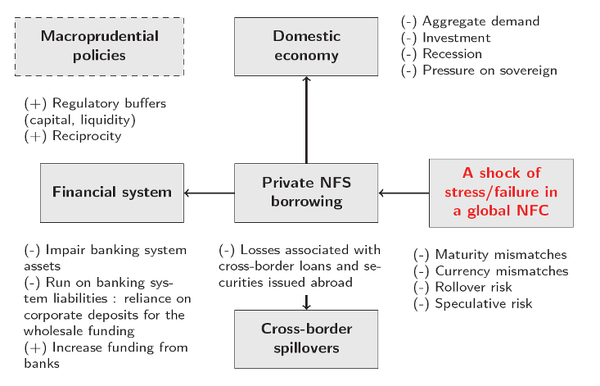

graphiqueThe Consequences of Private NFS Indebtedness for a Country’s Financial System and Economy

Message

It is important to improve our understanding of the role played by domestic and global factors in the recent dynamics of private sector borrowing, especially from the perspective of financial vulnerabilities. Once these factors identified, what should be done from a policy point of view? To date, the existing policy responses are implemented at the domestic level and take the form of fiscal policy measures and macroprudential tools. An additional aspect, that should not be ignored, is that of cross-border spillovers that would call for the need of coordinating across countries the policies implemented at the national level.

Article on one page (pdf, 69 Ko )