Economie et Statistique / Economics and Statistics n° 503-504 - 2018 Financial Incentives to Work in France between 1998 and 2014

THE ARTICLE ON ONE PAGE

Key question

To measure financial incentives to work, it is necessary to take into account all income-related schemes in the tax-benefit system. A measure is given by the effective marginal tax rate (EMTR) at the intensive margin and the participation tax rate (PTR) at the extensive margin. How are the EMTR and PTR distributed in the French population and how have they changed since the end of the 1990s?

Methods

EMTR and PTR are calculated by varying the hourly earned income of each working individual (3% for the EMTR and -100% for the PTR). Based on the Ines model, the social welfare benefits and taxes of each individual are simulated in a counterfactual situation, then in fictional situation in which the incomes are changed.

Main results

- In 2014, the median EMTR was 33%, as was the median PTR not taking into account employer contributions (respectively 57% and 55% taking them into account).

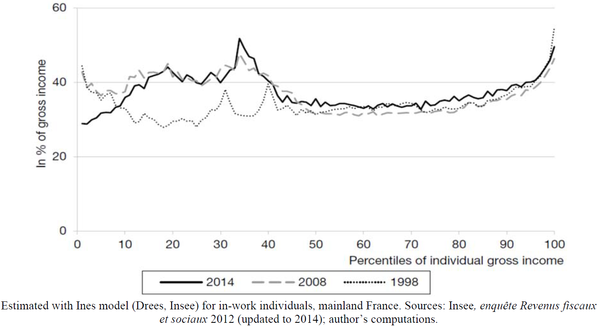

- The variability of the EMTR is high for low incomes and much less so at the top of the distribution. The distribution of the median EMTR by income level had a tilde shape in 2014.

- Couples have greater incentives to work than other family configurations. Women and men have similar incentives.

- EMTR and PTR have changed greatly since the end of the 1990s. The median EMTR was lower but the number of very high rates was higher, and the curve by income was U-shaped. PTRs were higher in the first third of the distribution.

graphiqueAverage EMTR According to Legislative Year by Percentiles of Gross Income

Message

Between 1998 and 2014, incentives to work at the intensive margin increased significantly at the extreme bottom of the distribution (but dropped between the 2nd and 4th decile), and those at the extensive margin increased greatly across the first third of the distribution. For both margins, there are fewer disincentive to work (EMTR and PTR higher than 100%). The introduction of work incentive schemes for low-income earners (RSA activité and PPE) have therefore achieved their objective.

Article on one page (pdf, 65 Ko )