Economie et Statistique / Economics and Statistics n° 500-501-502 - 2018 An evaluation of the methods used by European countries to compute their official house price indices

THE ARTICLE ON ONE PAGE

Key question

Since 2012, Eurostat requires the National statistical institutes (NSIs) in all European countries to compute official house price indices (HPIs) at a quarterly frequency. Because HPIs can be sensitive to the method used and this sensitivity can be a source of confusion amongst users,this article evaluates the theoretical properties of these methods, and their empirical comparability.

Methodology

Most NSIs use hedonic methods. These one – which express house prices as a function of characteristics – are ideally suited for constructing quality-adjusted HPIs and can be grouped into four classes: Repricing (RP) methods (most widely used, in particular in Belgium and Italy); Average characteristics (AC) ones (in particular, used by Spain); Hedonic imputation (HI) ones (used by Germany and UK); Rolling time dummy (RTD) methods (in particular, used by France). Some others use stratified medians method or a combination of actual prices with expert valuations. The theoretical properties of hedonic methods are compared through their formulas. Empirically, the methods are compared using micro-level housing datasets for Sydney (2003-2014) and Tokyo (1986-2016).

Main results

- Theoretically, it is shown that the underlying structures of 3 of the hedonic methods – the repricing, average charateristics and hedonic imputation methods – share common features. The RTD method is somewhat different in its approach.

- Empirically, the authors show, using housing (apartments and houses) transactions

for Sydney and Tokyo, that:

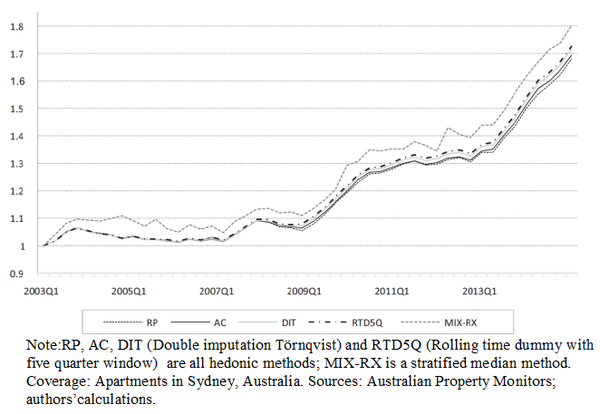

- HPIs computed using hedonic methods, exhibit better statistical performances (avoiding drift or high volatility problems) than others (stratified medians) over longer time horizons (e.g, 10+ years). In particular, for apartments in Sydney, the cumulative change in house prices from 2003Q1 is quite robust to the choice of hedonic method (Figure).

- Moreover, with each method, an NSI still needs to make a number of decisions when implementing it. The most widely used hedonic method, the repricing method, can become problematic when the hedonic model is not re-estimated every year.

- For smaller countries with less housing transactions, the HPI becomes more sensitive to the choice of method: the rolling time dummy (RTD) method performs better.

graphiqueEstimates of prices indices for apartments in Sydney (2003Q1= 1)

Main message

The official HPIs in Europe seem to be quite robust to the choice of hedonic method. The RTD method is particularly recommended: It is simple to compute and performs well on smaller datasets. NSIs using stratified medians should switch to a hedonic method when possible.

Article on one page (pdf, 143 Ko )