Economie et Statistique / Economics and Statistics n° 500-501-502 - 2018 Does information to buyers affect the sales price of a property? Mandatory disclosure and the hedonic price model – A test on French data

THE ARTICLE ON ONE PAGE

Key question

The hedonic method is the reference to analyse housing prices. However, it relies on the rather strong assumption that buyers and sellers have complete and perfect information on all the property’s characteristics. When characteristics are difficult to observe, as is the case for exposure to environmental risks for example, there may be information asymmetries between buyers and sellers. This article attempts to test the assumption of complete and perfect information using French housing sales data.

Methodology

The implementation of an obligation of information to buyers and tenants (IAL) on 1st June 2006 is used as an exogenous information shock in a natural quasi-experiment. A difference-in-differences hedonic price model is estimated using notarial data, spatially matched with maps of regulated zones covered by flood risk prevention plans (PPRi). The study covers transactions having taken place in 2006 in 484 municipalities covered by a PPRi and thus subject to an IAL requirement.

Main results

- The introduction of the IAL did not have an effect on average real estate sales prices in the flood zones at the scale of the 484 municipalities studied.

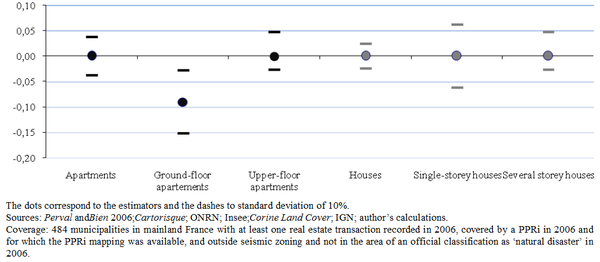

- Nonetheless, from the year that it was introduced, for certain categories of properties and in certain municipalities, we can observe a depreciative effect of the IAL on the sales price of non-new housing units. In fact, the introduction of the IAL led to an average fall of 9% of the price of ground-floor apartments in municipalities subject to a PPRi.

- The results also suggest that the introduction of the IAL had a negative impact on the price of houses in the least tense real estate markets.

graphiqueImpact of the IAL on the average transaction prices within and outside the PPRi zones (as a % of the price exclusive of fees)

Message

The IAL has changed the perception of some buyers regarding natural risks while, if information was perfect and complete, the impact should be nil. This invites caution in interpreting the results of the hedonic price model, particularly for attributes that are not directly observable. However, the overall effect of the IAL on information and risk perception by acquirers appears to be limited in 2006. It is possible that the IAL, a technical document that may be difficult to understand, does not provide households with sufficient information or that, in its initial form, the information has reached too late in the negotiations (signing the promise or even the deed of sale).

Article on one page (pdf, 154 Ko )