Economie et Statistique / Economics and Statistics n° 500-501-502 - 2018 The impact of the 2014 increase in the real estate transfer taxes on the French housing market

THE ARTICLE ON ONE PAGE

Key question

What is the impact of a change in taxes on the volume of housing transactions? This paper estimates the effects of an increase in the real estate transfer taxes (RETT) rate from 3.80% to 4.50%, following an optional reform implemented in March 2014 by French départements. The RETT, or droits de mutations in French, are taxes levied on all transfers of ownership of real estate or land. The RETT are an important source of revenue for the French départements: they represent around €10 billion per year.

Methodology

The fact that not all the départements implemented the RETT increase, and not at the same time, is used as the starting point for a natural experiment. A difference-in-differences design is applied to estimate the impact on the volume of transactions. The estimations use various datasets on property transfer taxes and local taxes (DGFiP, Insee), on new building projects (Sit@del2), and regional budgets from 2012 to 2015.

Main results

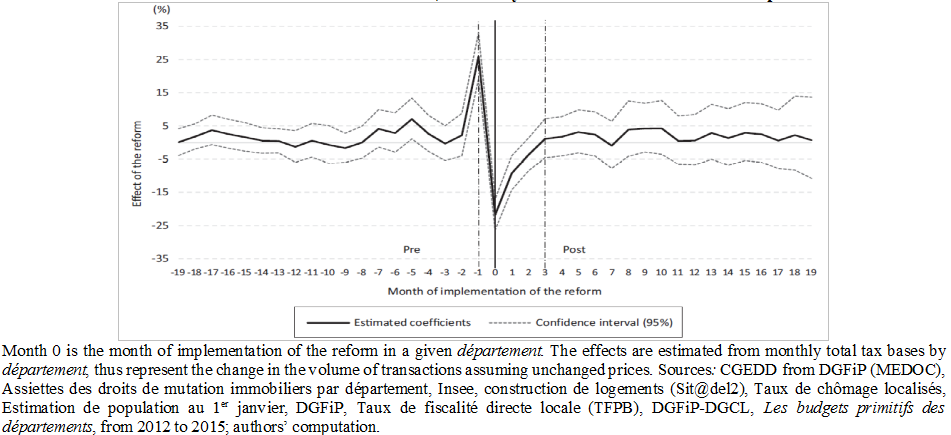

The estimations show compelling evidence of a short-term effect of a RETT increase.

- An anticipation effect of 26% just the month before the implementation of the reform in order to avoid the RETT increase (timing response).

- A retention effect in post-reform period – a classic depressing effect of a tax on the equilibrium quantity or extensive margin response, augmented here by a re-timing effect – estimated to be 14% on average per month over the three months following the implementation.

- The two effects do not cancel out. All in all, the net effect (extensive margin response solely) corresponds to an average monthly drop of the transactions of around 6% over the three initial months. The corresponding rough estimate of the lost transactions is around 15,000, a conservative figure.

- It is not found any evidence of medium- or long-term effect of the tax increase, thus showing a strong resilience of the housing market.

- The corresponding elasticity of the tax bases to the tax increase is about - 0.42, meaning that the behavioral response reduces the potential gain of tax revenues for départements of 42% over the first quarter after the reform. We conclude that départements’ tax revenues are still on the increasing side of the Laffer curve (the relation between tax revenues and tax rate).

graphiqueEffect of the reform on the volume of transactions, month by month before and after the implementation date

Main message

These results might be used to discuss the impact of future RETT’s reforms in link with their effect on the housing market. Even if the RETT rise was a “good deal” for the départements in terms of tax revenue, the distorting effect of the tax reform was assessed: some people who could have become owners or moved from one place to another did not because of the reform (i.e. lock-in effect). Consequently, we conclude that the RETT increase has a negative sizable (short-term) impact on mobility and well-being.

Article on one page (pdf, 185 Ko )