Economie et Statistique / Economics and Statistics n° 500-501-502 - 2018 Consumption, household portfolios and the housing market in France

THE ARTICLE ON ONE PAGE

Main question

The financial crisis demonstrated the importance of interactions between the financial sector and the real economy, neglected in representative-agent New Keynesian DSGE (Dynamic Stochastic General Equilibrium) models. For household spending, current central bank non-DSGE econometric policy models summarise household portfolios in a single net worth measure and neglect shifts in credit conditions. How to relax these restrictions and generalize, in a tractable model, the interactions of the household sector and finance for France, is the question.

Methodology

The model includes equations for consumption, house prices, mortgage debt, consumer credit, liquid assets, and permanent income. Controls include credit conditions (as latent variables), interest rates, income expectations and demographics. It is estimated by maximum likelihood methods for French quarterly data from 1981 to 2016.

Main results

- Financial liberalization relaxed French mortgage credit conditions from 1984. Subsequent variations are strongly inversely correlated with banks’ non-performing loans. Without these controls, a coherent house price model is unobtainable.

- Permanent income matters for consumption but also current income.

- Financial wealth effects are comparable to those in the US or the UK, with a marginal propensity to consume out of liquid assets minus debt far greater than for illiquid financial assets. But housing wealth or collateral effects in France are much weaker in aggregate, given the absence of home equity loans. Higher house prices, ceteris paribus, reduce aggregate consumption, probably because tenants, including prospective owner-occupiers, save more in a context of relatively strict financial regulation and prospects of rising rents.

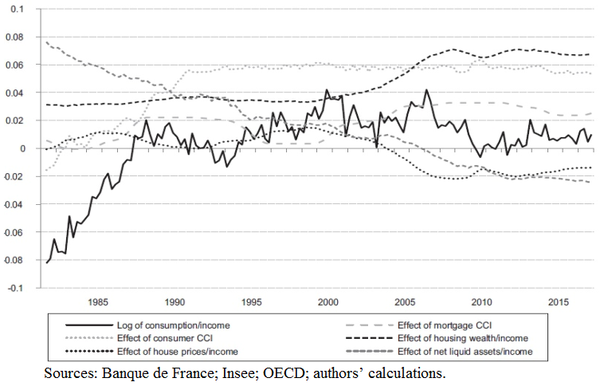

graphiqueLong-run effects on log consumption/income in France

Main message

Consumption and wealth co-move because of shifts in credit conditions, interest rates, income expectations or demographics, whose impact should be identified to disentangle wealth effects and to illuminate direct and indirect monetary policy transmission on consumption. During the French house price boom between 1996 and 2008, a small positive housing wealth effect on consumption and looser mortgage credit conditions, were offset by the negative effect of higher house prices and higher debt, see figure. Therefore, the financial accelerator in France was weaker than in the US or the UK. Incorporated in a larger econometric model, this household sector model is useful for examining monetary policy issues, including financial stability.

Article on one page (pdf, 149 Ko )