Economie et Statistique / Economics and Statistics n° 500-501-502 - 2018 New or old, why would housing price indices differ? An analysis for France

THE ARTICLE ON ONE PAGE

Key question

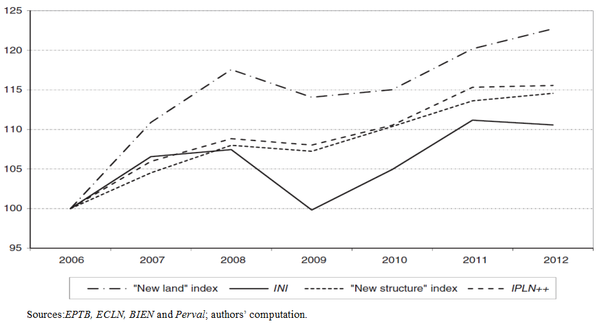

Over the period 2006-2015, the evolution of the price index for second-hand dwellings (Indice Notaires-Insee, INI) differs fromthat of thenew homesprice index (Indice de Prix des Logements Neufs, IPLN), especially in 2009-2010 during the crisis. Does it come from the different computation methods of the two indices? From the more restricted scope of the new dwellings price index? Or, more profoundly, from factors relating to differences in the characteristics of the housing markets for new and for second-hand dwellings?

Methodology

The empirical exploration combines transaction data from the Notaries, surveys on the commercialisation of new dwellings (ECLN) and on the prices of building land (EPTB). The same time-dummy method is applied to compute different indices:a more encompassing index (IPLN++), and separate price indices for newly built land and structure.

Main results

- Unifying methods and scopes does not eliminate the differences in the evolutions of the two indices, and comparing only second-hand homes located in the same municipalities as new homes reduces, but still does not eliminate, the differences.

- Land leverage is lower for new houses, built where land is cheaper, than for existing dwellings. Land price evolution is the main driver of second-hand housing prices that have a higher land leverage. Construction (i.e structure) prices and new homes prices have a more similar, less volatile evolution. Still, construction prices seem also sensitive to the trend in land prices.

- The countercyclical building of social housing might have contributed to the lower volatility of new homes prices.

graphique“New land” index, “new structure” index, IPLN++ and INI

Main message

The price indices of second-hand dwellings, with a higher land leverage, are more volatile than those of new dwellings. This seemed to be the case at the turning point in 2009. The shock in demand seems to have affected land values more than the value of structures. This calls for more research on the workings of the market for new and for second-hand homes, to explore why the former has been less reactive than the latter in terms of prices. It would also be interesting to renew the exercise to check if the difference between the evolutions of the two indices is observed over longer periods of time.

Article on one page (pdf, 173 Ko )