Global value chains : International sourcing primarily to the European Union

Global value chains : International sourcing primarily to the European Union

Between 2009 and 2011, 4.2% of non-financial companies in the market sector with 50 or more employees located in France sourced internationally their activities and 3.1% considered doing so although eventually did not. The sectors most affected were the manufacturing industry and information and communication services. Companies that sourced internationally were usually exporters or already present abroad through subsidiaries. Almost all were part of a group and sourced internationally for the most part within the group. The tendency to source internationally also increased with the size of the company. The most favoured destinations for international sourcing were the fifteen original European Union states (EU15), followed by Africa and the new EU Member States, then China and India. The main reason was to reduce wage costs or other cost considerations, followed by the opportunity to reach new markets. Reasons for sourcing internationally to the EU15 were more varied than for moving to the other areas.

- In three years, 4.2% of non-financial companies in the market sector with 50 or more employees sourced internationally their activities

- More international sourcing in manufacturing and information-communication

- Most international sourcing by exporting companies or large companies

- Majority of international sourcing to the European Union

- Companies prefer to source internationally within their group

- Looking for lower costs, but not only lower wages

- Remain close to existing clients rather than source internationally

- International sourcing and job losses, the figures

In three years, 4.2% of non-financial companies in the market sector with 50 or more employees sourced internationally their activities

Over the last twenty years the global business environment for companies located in France has changed profoundly. There has been a drop not only in import tariffs, but also in transaction and data processing costs, coupled with the emergence of new industrialised countries where labour costs are low. All of which has resulted in companies and groups rethinking the way they are organised and reconsidering the location of their activities. The Chaînes d’activité mondiales (Global value chains of activity) survey carried out by Insee in 2012 (sources) looked at the strategic choices made by companies between performing activities themselves and having them done by others. When they carry out activities themselves, production is internalised ; when they call on others, all or part of the company’s activities are sourced, or externalised, either in France or abroad. When activities are carried out by another company located abroad, this is defined as international sourcing, where the internationally sourced activity may previously have been carried out within the company or it may already have been sourced in France.

It is only to be expected that a company concentrates its resources on those activities that it can carry out most effectively and considers contracting with other firms for the rest. This sourcing of certain tasks is a longstanding practice in industry, but it was always the norm to use service providers that were close by, and hence located in France. With the fall in communication and information processing costs, the issue is now much more likely to be considered in an international context, both for industrial activities and for services.

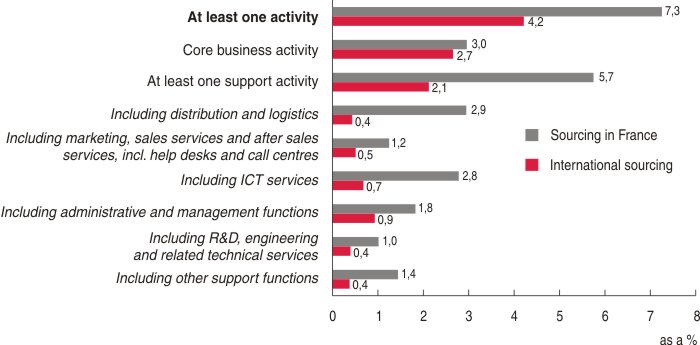

In 2012 there were 28,000 non-financial companies in the market sector which had at least 50 employees at the end of 2008 located in France. According to the Chaînes d’activité mondiales survey, in the course of the three years from 2009 to 2011, 4.2% of these companies sourced internationally some or all of their activities (graph 1). These companies accounted for almost 500,000 employees in 2011, or 6.5% of jobs in the 28,000 companies studied. Similarly, almost as many companies (3.1%) considered international sourcing, although they did not actually do so and 7.3% of companies sourced part of their activities to another company located in France. In all, 10.1% of non-financial companies in the market sector with 50 or more employees sourced in France, or sourced internationally some of their activities.

graphiqueGraph 1 – Proportion of companies with 50 or more employees that sourced in France or sourced internationally activities between 2009 and 2011

- How to read it: 7.3% of non-financial companies in the market sector with 50 employees or more sourced at least one activity in France (totally or partially) and 4.2% sourced internationally at least one activity (totally or partially).

- Scope: non-financial companies in the market sector with 50 employees or more (end 2008) located in France, whose sector falls within divisions 05 to 82 (excl. 64 to 66) of NAF rev.2.

- Source: Insee survey, Chaînes d’activité mondiales.

More international sourcing in manufacturing and information-communication

The manufacturing industry and information and communication services were the two sectors where international sourcing occurred most frequently, with 8.8% of companies concerned in both instances (graph 2). In 2011, these represented 13.6% and 19.2% of all jobs in companies with 50 or more employees in their respective sectors.

In manufacturing, the production of electrical equipment (25% of the companies concerned) and computers, electronic and optical products (22%) were most particularly concerned. In the information and communication services sector, it was mainly services linked with computer activities that sourced internationally (11%). In contrast, the construction, transport, hotel, catering and real estate sectors sourced internationally very little between 2009 and 2011 (less than 1% of the companies concerned).

In the period of observation, internationally sourced activities in the manufacturing industry were related more to the company’s core business, and in the other sectors to support activities.

graphiqueGraph 2 – Proportion of companies with 50 or more employees that sourced internationally activities between 2009 and 2011, according to different criteria

- How to read it: 7.7% of non-financial companies in the market sector with 50 or more employees and which exported in 2009 sourced internationally at least one activity, totally or partially.

- Scope: non-financial companies in the market sector with 50 employees or more (end 2008) located in France, whose sector falls within divisions 05 to 82 (excl. 64 to 66) of NAF rev.2.

- Source: Insee survey, Chaînes d’activité mondiales.

Most international sourcing by exporting companies or large companies

Between 2009 and 2011, the proportion of companies to have sourced internationally part of their activity was naturally greater where the workforce was larger : 5.9% of companies with 100 employees or more at the end of 2008 were concerned, compared with 2.7% of those with 50 to 99 employees. And this percentage was as high as 7.6% for companies of 250 employees or more and 10% for those with 5,000 employees or more.

Companies that were part of a group in 2009 sourced internationally more than independent companies (5.2% compared with 1.6%). When groups were international in scale, this strategy was more pronounced : 12.7% of companies that were already present abroad in 2009 through subsidiaries sourced internationally between 2009 and 2011. This percentage was 20.8% when these companies also formed part of a foreign group.

Many more exporting companies sourced internationally (7.7%) than companies whose market was solely in France (0.7%). For a given sector, size and company type (type denoting whether or not the company was part of a group, whether the group was French or foreign, and whether or not the company controlled subsidiaries abroad), exporting companies sourced internationally on average four times more often than non-exporting companies.

Majority of international sourcing to the European Union

Of the companies that sourced internationally between 2009 and 2011, 55% moved into the European Union (EU) : 38% to the EU15 Member States and 22% into the new Member States, with companies sometimes moving into several countries (table 1). Africa was also high on the list with 24%, due to its proximity to France and the fact that French is spoken in some African countries. China (18%) and India (18%) offset the fact that they are far away and have a business environment that is sometimes considered less attractive with advantages in terms of industrial fabric, labour costs and size of the domestic market.

The EU is by far the preferred destination for French companies moving their support activities (65%), due to the quality of the contractual environment. A quarter of companies that sourced internationally this type of activity moved into India, especially administrative or management services, computer or telecommunications services and design, research and development (R&D), engineering and technical services. The international sourcing of support activities to Africa concerned mainly marketing, after-sales service and call centres, for the obvious reason of a common language.

tableauTableau 1 – Host countries for international sourcing of activities between 2009 and 2011 by companies with 50 or more employees

| Companies sourcing internationally % | For each activity, as a % of the number of companies sourcing internationally this activity | |||||||

|---|---|---|---|---|---|---|---|---|

| European Union | Africa | China | India | United States and Canada | ||||

| EU | Incl. EU15 | Incl. new Member States | ||||||

| At least 1 activity | 4.2 | 55 | 38 | 22 | 24 | 18 | 18 | 8 |

| Core business | 2.7 | 44 | 28 | 19 | 27 | 26 | 12 | 6 |

| At least 1 support activity | 2.1 | 65 | 48 | 24 | 16 | 9 | 26 | 9 |

- NB: for each activity, the sum of the percentages is greater than 100% because a company may have sourced internationally several activities to different geographical areas over this period.

- How to read it: 2.1% of non-financial companies in the market sector with 50 or more employees sourced internationally (totally or partially) at least one support activity. 65% of these companies sourced internationally at least in part to the European Union.

- Scope: non-financial companies in the market sector with 50 employees or more (end 2008) located in France, whose sector falls within divisions 05 to 82 (excl. 64 to 66) of NAF rev.2.

- Source: Insee survey, Chaînes d’activité mondiales.

Companies prefer to source internationally within their group

94% of companies that sourced internationally between 2009 and 2011 belonged to a group, and for the most part they sourced internationally within their group : this was the case for 73% of companies, while only 35% chose partners outside the group (table 2). When companies chose to source internationally to one of their subsidiaries, in the vast majority of cases this was a pre-existing subsidiary.

Companies that sourced internationally core business usually did so within the group (80%) rather than outside it (28%). For support functions, the gap was not so wide (66% compared with 41%). However, for support activities relating to design, R&D, engineering and technical services, the group was far and away the preferred target for international sourcing (85% compared with 19%).

tableauTableau 2 – Partners hosting internationally sourced activities between 2009 and 2011 by companies belonging to a group

| Proportion of companies from a group sourcing internationally % | For each activity, as a % of companies belonging to a group and having sourced internationally this activity | ||||||

|---|---|---|---|---|---|---|---|

| Within the group | Outside the group | ||||||

| Within the group | Incl. to a subsidiary already in existence before international sourcing | Incl. to a subsidiary acquired for the international sourcing | Incl. to a new subsidiary set up for the international sourcing | Incl. to a company in the group excluding subsidiaries | |||

| At least 1 activity | 5.2 | 73 | 30 | 5 | 8 | 39 | 35 |

| Core business | 3.2 | 80 | 37 | 3 | 11 | 38 | 28 |

| At least 1 support activity | 2.8 | 66 | 20 | 6 | 3 | 42 | 41 |

- NB: for each activity, the sum of the percentages is greater than 100% because a company may have sourced internationally to different types of partner over this period.

- How to read it: 2.8% of non-financial companies in the market sector with 50 or more employees belonging to a group sourced internationally (totally or partially) at least one support activity. 41% of these companies sourced internationally at least partly outside the group and 66% sourced internationally at least partly within the group.

- Scope: non-financial companies in the market sector with 50 employees or more (end 2008) located in France, whose sector falls within divisions 05 to 82 (excl. 64 to 66) of NAF rev.2.

- Source: Insee survey, Chaînes d’activité mondiales.

Looking for lower costs, but not only lower wages

International sourcing to the emerging countries like India and China is often motivated by access both to low costs, which may include low wage costs, but not exclusively, and to promising markets (sources). In the case of the new EU Member States too, wage costs can be attractive. For international sourcing to the EU15, companies are primarily looking to reduce production costs other than wages and their reasons for international sourcing are much more diverse. International sourcing to Africa, on the other hand, are mainly because companies are looking for low wage rates for labour-intensive activities. Note that for companies that form part of a group, the decision to source internationally often stems from strategies prepared by the head of the group, irrespective of the area to which international sourcing will take place.

Remain close to existing clients rather than source internationally

As we have already seen, 3.1% of companies covered by the scope of the survey considered international sourcing, but did not in fact do so. Eight times out of ten, these were exporting companies. More than half of these companies cited uncertainty about the quality of goods and services produced once the international sourcing had taken place as a considerable obstacle, as well as the need to be in close contact with existing clients. Legal or administrative barriers and anxiety among the workforce or the unions followed close behind.

Obstacles also emerged for those companies that did source internationally (sources). Concerns among employees and the unions were often mentioned as a great obstacle or even a very great obstacle ; in fact this was the only really major obstacle mentioned in the context of international sourcing to the EU15. Concerns about the quality of goods and services produced were the main problem for companies sourcing internationally to China, India or Africa. The need to stay close to existing clients was also often a very important obstacle when sourcing internationally to Africa and China. Also mentioned as very important obstacles when sourcing internationally to Africa were legal or administrative barriers, inadequate management and expertise, and political and economic instability in the area. When sourcing internationally to China, concerns about the protection of intellectual property rights were considered as a very big obstacle, while the difficulty in identifying suitable foreign suppliers or import tariffs and non-tariff barriers were often mentioned as important obstacles, but rarely as very important.

International sourcing and job losses, the figures

The Chaînes d’activité mondiales survey estimated that about 20,000 jobs would be shed in France as a direct result of international sourcing between 2009 and 2011 by non-financial companies in the market sector with 50 or more employees, or about 6,600 jobs shed per year over these three years. These 20,000 job losses represent 0.3% of salaried employment in 2011 in all the companies within the scope of the survey and 4% of jobs in companies that sourced internationally. Two-thirds of the jobs shed concerned the core business of the internationally sourced companies. In the manufacturing industry, 11,500 jobs appear to have been shed as a result of international sourcing carried out between 2009 and 2011, or 0.6% of salaried employment in all companies in the manufacturing industry within the scope of the survey.

These figures, which reflect the microeconomic impact of international sourcing in terms of employment, must be interpreted with care. They are declarative figures and only take into account the direct shedding of jobs without considering those which may be removed in the company’s subcontractors, or, conversely, jobs that may be located inside France as a result of the same type of movement from abroad. The question that also has to be considered is how the job situation would have changed if the international sourcing had not taken place.

Different studies have already looked at the impact of international sourcing on employment (bibliography). Several of these measure the effect of the increase in trade between France and the host countries on the share of industry in total employment : these are based on aggregated data, and using an econometric approach (Boulhol and Fontagné, 2006 ; Demmou, 2010), or on an accounting approach based on input-output tables from the national accounts (Demmou, 2010), or on individual company data (Aubert and Sillard, 2005 ; Jean, Hijzen and Mayer, 2011). All previous studies came up with similar figures for the effects on employment, and were slightly higher than the figures obtained in the Chaînes d’activité mondiales survey.

For example, the study by Aubert and Sillard, published by Insee, defines international sourcing by the decline in activity in France and the resulting importation of products from a subsidiary located abroad. Job losses in the manufacturing industry due to international sourcing are estimated at between 9,000 and 20,000 per year, but these include a large proportion of jobs shed by subcontractors. Moreover, the study by Aubert and Sillard covers the period 1995-2001, which corresponds to the massive expansion in China and the emerging countries in central and eastern Europe, whereas 2009-2011 was a period of crisis during which companies expanded much less abroad.

Sources

The Chaînes d’activité mondiales survey was carried out by Insee from June to October 2012 in the framework of a European project to improve knowledge of company internationalization strategies. It covers the period from the beginning of 2009 to the end of 2011 and looks at non-financial companies in the market sector with 50 or more employees at the end of 2008 and whose sector of activity corresponds to divisions 05 to 82 (excluding divisions 64 to 66) of the NAF rev.2 classification. The companies surveyed were legal units as per the legal definition of an enterprise and not that used in the French law on the modernisation of the economy (LME) ; this is why the results are presented using the term «companies» rather than «enterprises».

The motivation behind international sourcing and the obstacles in its way in each area were obtained by analysing the responses from companies that had internationally sourced to a single area.

Définitions

International sourcing of an activity : total or partial transfer of this activity to a company located abroad (which may or may not belong to the group). Before being internationally sourced, this activity may have been carried out within the company or have already been sourced to a company in France. This is therefore a fairly wide definition, since we can say that when a company is the ordering party and hands over to a subcontractor abroad an activity that had until then been carried out by a subcontractor located in France then the company has sourced internationally this activity. For the purposes of this survey, the international sourcing of the activity must have resulted in a reduction in this activity in France. For example, setting up a new production line abroad without making a corresponding reduction in production in France is not considered as international sourcing.

Sourcing of an activity in France : total or partial transfer of this activity to a company located in France (which may or may not belong to the group).

Core business : this is the production of goods or services destined for markets or third parties, carried out by the company and generating a turnover. This is usually the company’s main activity. It may also include other secondary activities if the company considers that they make up part of its essential functions.

Support activities : these are activities carried out by the company to allow or facilitate the production of goods or services for the market or for third parties. Productions from these support activities are not destined directly for the market or for third parties.

Pour en savoir plus

Further tables are available in the Internet version of this study at www.Insee.fr.